PSD2 Compliance & SCA in retail

How to navigate the regulations from now until strict enforcement begins

PSD2 Compliance & SCA in retail

How to navigate the regulations from now until strict enforcement begins

The PSD2 Challenge in detail

As fraud levels in digital payments have risen in Europe, new regulatory obligations have followed. Strong Customer Authentication (SCA) has become a key piece of the EU’s Revised Payment Services Directive (PSD2) required by merchants.

But building additional authentication into the checkout flow presents a real challenge for merchants who strive to protect the customer experience. Preparing for the new security standard requires merchants to rethink their payment processes to ensure minimal disruption to their businesses.

How to operate exemption management to minimize cart abandonment

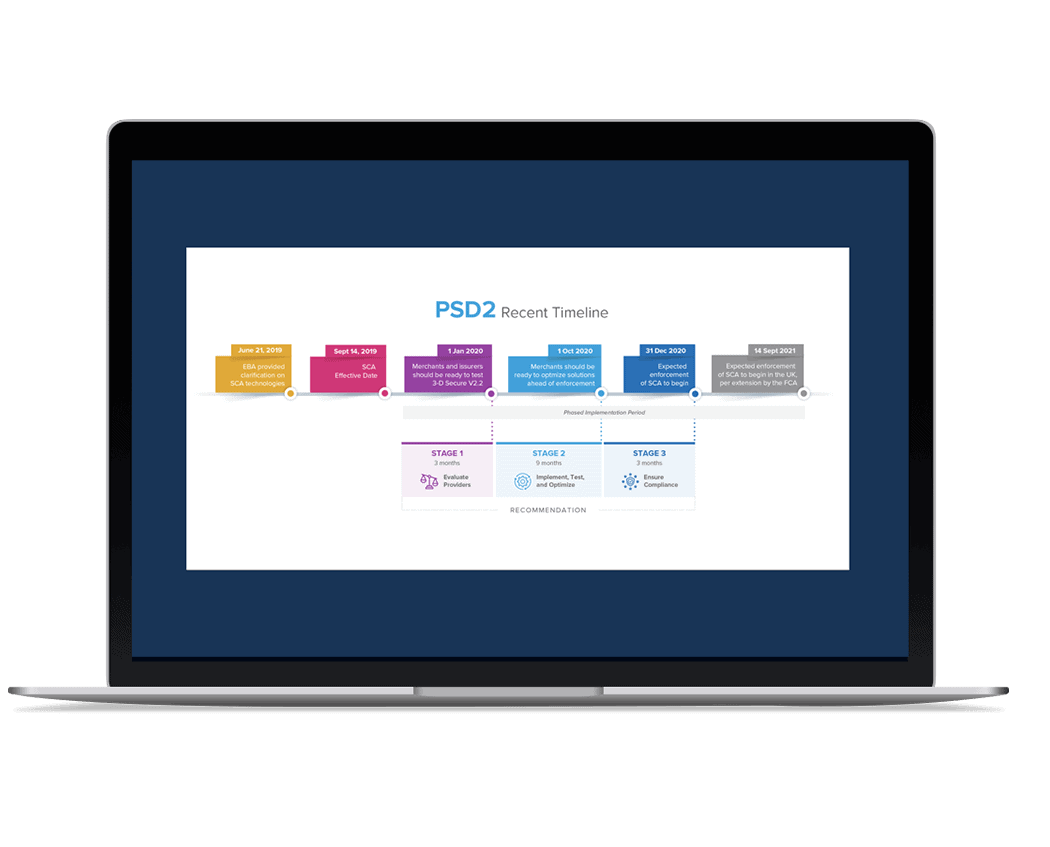

Not all transactions will be affected. The first challenge is to know in what specific cases they are exempt from PSD2’s SCA requirement. As with most European Directives the details have been changing and are likely continuing to change as we approach the compliance deadline - a deadline that’s already been extended twice. Keeping up with the most recent developments is an important part in managing the exemptions, which will minimize friction for your buyers.

Think of it as an important first step in embracing the rest of what PSD2 requires and has to offer.

How to implement Strong Customer Authentication (SCA) with minimal friction?

PSD2 introduced the concept of Strong Customer Authentication (SCA). The idea is simple: 2 out of 3 elements need to be checked during authentication. However, implemented poorly, this causes friction which hurts the checkout funnel of online merchants.

The newest version 2.2 of the 3-D Secure protocol allows for a seamless design, almost to the point buyers won’t notice anything at all. In 2019, Signifyd’s solution became the first to receive the official EMVCo certification for 2.2. You will not find a better 3DS implementation anywhere.

How to reduce revenue leakage at every stage of your buyer’s journey

During revenue conversion assessments with enterprise merchants all across Europe, we noticed that many of them, often due to legacy technology such as outdated 3-D Secure versions, were bleeding revenue every day. On average they saw an 8.3% revenue boost after switching to Signifyd.

Our Commerce Protection Platform is designed to protect the shopping experience from friction and maximize the revenue conversion across the entire funnel. This helps you sustain your business today - and proactively solves all your future PSD2 concerns long before the enforcement deadline is upon us.

8.3% Revenue bleed on average

While you could wait to act until the PSD2 compliance deadline is upon us, you can’t afford to lose the revenue you’re bleeding today because of legacy technology in your payments stack. Not in today’s world.

Let us show you how much every day you wait is costing you.