What trends are we seeing in the 2024 back to school shopping season data?

Online retailers looking for holiday-season clues in back-to-school shopping data might want to break out the discounts as ongoing price pressure heightened consumers’ hunger in July for lower-priced alternatives, according to Signifyd data.

Shoppers are still spending, driving online sales up 10% last month over July 2023, but it’s how they’re spending that is notable.

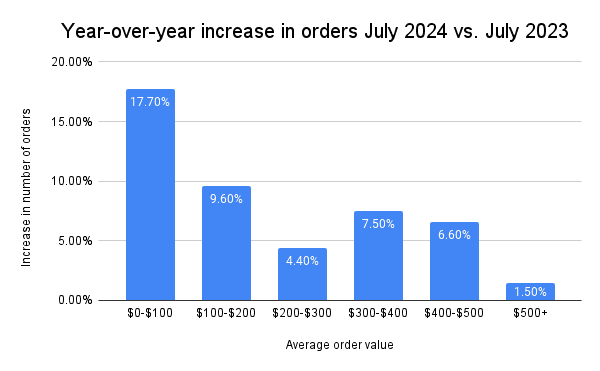

Signifyd’s monthly Ecommerce Pulse report indicates that economic stressors are translating into significant consumer caution. Looking at the average spending per digital shopping trip shows that the fastest growth was in orders under $100. Meanwhile, the slowest growth registered in orders above $500.

- Online spending continued to grow annually in July, but the fastest growth was in orders under $100. Meanwhile, purchases above $500 were nearly flat year over year.

- Clues to the health of the upcoming holiday shopping season remained elusive. Overall online spending was up 10% annually, but growth was powered by discounts and consumers trading down for cheaper items.

- Average order value was down 4% compared to July 2023, signaling caution among consumers.

During the height of back-to-school shopping, consumers also turned to discounts. That’s hardly a new trend, but something for retailers to ponder as they work to maintain profit margins while also keeping loyal customers and attracting new ones,

Signifyd CEO Raj Ramanand

“What we saw in July was not surprising given recent macroeconomic trends,” Signifyd CEO Raj Ramanand said. “Online retail remains healthy, but clearly economic uncertainty and the decline in surplus savings are weighing on consumers. We’ve entered an era during which merchants need to focus on profitable growth rather than growth at any cost. This is the time for brands to develop lasting customer value by doubling down on the long-term relationships they build with the customers they serve.”

What the back-to-school shopping data can tell us about the upcoming holiday shopping season

So, what does all this mean for the holiday shopping season, which no doubt will kick off any day now? While it’s a little early to close the books on back-to-school 2024, the intense shopping period has historically been a trusty predictor of the Q4 shopapalooza that can make or break the year for many retailers.

“This is the time for brands to develop lasting customer value by doubling down on the long-term relationships they build with the customers they serve.”

Signifyd CEO Raj Ramanand

If the back-to-school-as-bellwether trend holds, online merchants can be encouraged by the overall increase in year-over-year online sales. But they should also be mindful of the shift to lower cart sizes. Despite higher total spending, the average value of each order placed dropped by 4%, another sign that consumers are being cautious this back-to-school seaso

Got 50 seconds? This is all you need to know

Yes, this blog post has a lot of good stuff in it. But, if you’re in a hurry, this 50-second video will give you all you really need to know about Signifyd’s July Ecommerce Pulse report.

Have a look. And if it’s not too much to ask, come back and give this a read when you have more time.

Consumers are spending less in the face of ongoing price pressure

“The decline in average order value is somewhat worrisome,” said Signifyd Senior Data Analyst Phelim Killough, who prepared the July Ecommerce Pulse report. “Add to that the fact that cart size — or the number of items per order — was down 9% and it’s a less-than-glowing report. Higher overall spending, lower average order value and smaller cart sizes tell the story of consumers who are trading down and finding cheaper options for the things they need.”

A closer look at July spending amplifies Killough’s point. The total number of orders in July increased by 15% compared to a year ago. The growth was driven by lower-cost purchases. Breaking down average spending per order into $100 increments, Signifyd found that orders under $100 increased 17.7% compared to July 2023. Conversely, orders over $500 rose only 1.5% over a year ago.

Consumers are looking for low-low prices and discounts

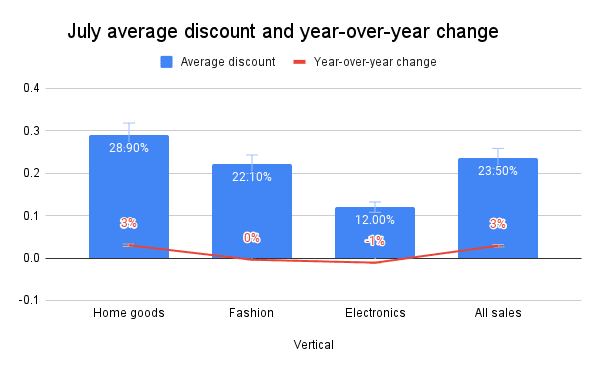

And while consumers were hunting for bargain brands and lower-cost items in July, they were also reaching for discounts. The average discount for all transactions across Signifyd’s entire Commerce Network of thousands of retailers was 23.5% — a 3% increase from discounts applied in July 2023, according to an analysis of orders placed with a discount code.

Zeroing in on traditional back-to-school and back-to-college categories, we see the average applied discount in the electronics category was 12%. Fashion shoppers enjoyed an average discount of 22%, about the same as last year. Home goods discounts averaged nearly 29% or 3% higher than a year ago — but even those deals weren’t enough for shoppers to push home goods spending higher than last July.

Are consumers finally getting pricing fatigue?

Economists have been warning that consumer spending — a growth engine that has been roaring since the end of the pandemic — could not run hot forever. Record savings, bolstered by pandemic stimulus payments, are dwindling and strong employment growth took a dip in July, panicking equity markets for a day.

The intense focus on lower-cost items and discounts could be early signs that slower spending will follow. But, to rely on the classic hedge, it’s too early to tell. Looking at winners and losers in July by retail category shows an even split between categories that saw sales increases and those that didn’t.

Back-to-school shopping surfaces wants and needs

Reflecting the confounding nature of the economy overall, shoppers spent freely in some retail verticals in July while pulling back in others. Traditional back-to-school and back-to-college verticals were a mixed bag. Apparel spending was up 12% over a year ago, while electronics remained flat and home goods spending dropped 8%.

On the spectrum of back-to-school wants and needs, some apparel is a must-have, while a mid-range laptop can substitute for the top-of-the-line and maybe it’s milk crates and 1-by-12s rather than a new bookcase for that off-campus apartment.

Grocery is up; beauty and cosmetics is down

Other verticals that saw notable annual sales fluctuations in July include grocery, leisure and outdoor, and luxury goods. Grocery spending continued a trend that started in the spring, increasing 27% over last July. Again in July, the rise in spending was driven by volume, not price increases. Auto parts and beauty and cosmetics were in negative territory year-over-year, down 1% and 9% respectively.

How we figure it — data-wise

Signifyd’s Ecommerce Pulse data is derived from transactions on Signifyd’s Commerce Network of thousands of ecommerce retailers and brands. Commerce Network intelligence also powers Signifyd’s Commerce Protection Platform, which leverages AI-driven machine learning models and data from billions of transactions to detect and block fraudulent activity while increasing the number of good orders approved. Signifyd has seen more than 600 million unique shopper wallets globally, meaning that 98% of the time when a shopper comes to a Signifyd-protected site, Signifyd’s machine-learning models recognize the shopper instantly.

Feature photo by Getty Images

Want to make the most of holiday 2024? We can help.