Maybe you remember the flow charts or even clever videos from elementary school that traced the process of how a bill becomes a law.Online payments and credit card processing are like that with a lot less posturing and politicking. But the chain of events set off by a consumer clicking the buy button on an ecommerce site includes just as many twists, turns, back-and-forths, and if-this-then-that junctions. That it all happens in a matter of seconds — real-time processing — is something of a mercantile miracle. This guide is meant to demystify the payments landscape and credit card processing while identifying the players that do the behind-the-scenes work of moving money in the form of ones and zeros from a customer’s account to a retailer’s bank account. It’s a world of issuers, acquirers, payment processing companies, payment gateways, ISOs, ISVs, aggregators, orchestrators, operators and marketplaces — each with an important function.And that’s the place to start — the who’s who of the digital payment chain when it comes to card transactions.

1) Payment networks

Payment networks — sometimes called payment brands or associations or card brands, or payment schemes if you’re in the UK — are the credit and debit card brands that you’re no doubt familiar with. They include names like Visa, Mastercard, Discover and American Express. On the debit side, there is Star, Jeannie, PULSE and NYCE.

2) Issuers

Issuers, usually a bank (aka issuing bank), are entities that the payment networks (such as Visa, Mastercard and others) license to issue credit or debit cards bearing the brand’s logo.Principal licensed members are fully licensed members of the brand’s network. They have a direct relationship with the payment brand itself. While there are exceptions, these are usually large financial institutions such as U.S. Bank, Bank of America, Capital One and others.

- Associate or affiliate members are organizations that a principal licensed member has sponsored. These issuers don’t have a direct relationship with the payment brand, and everything must go through their principal licensed sponsor. These tend to be smaller regional banks and hometown credit unions.

3) Acquirers

Acquirers, sometimes called merchant acquirers or acquiring banks, are licensed by the card brands to accept payments from that brand’s licensed issuers on behalf of a merchant. There are two types of acquirers:

- Principal licensed acquirers have a direct relationship with a card brand. Again, they tend to be the bigger players, like Citizens, Capital One, Wells Fargo and others. There are exceptions.

- Associate or affiliate acquirers are sponsored by the licensed acquirers to accept payments from licensed issuers.

4) Payment processors

Bingo. While the merchant’s account is with an acquirer, most acquiring banks don’t have the infrastructure in place to process the transactions that trigger the payment to the merchant’s account. The acquirer relies on payment processors — companies like Worldpay from FIS and Fiserv — to handle the task. The processor’s activity is sponsored by a licensed member of the payment network — aka a licensed acquirer. The payment processor transmits the transaction data among the cardholder, merchant, issuer and acquiring bank.

5) Payment gateways

A payment gateway provides the virtual equivalent of a point-of-sale (POS) terminal. They provide a secure way to capture and send card data to the processor in a card not present (CNP) environment. They also communicate the approval or rejection messages to the consumer and merchant.

6) Stages of a transaction

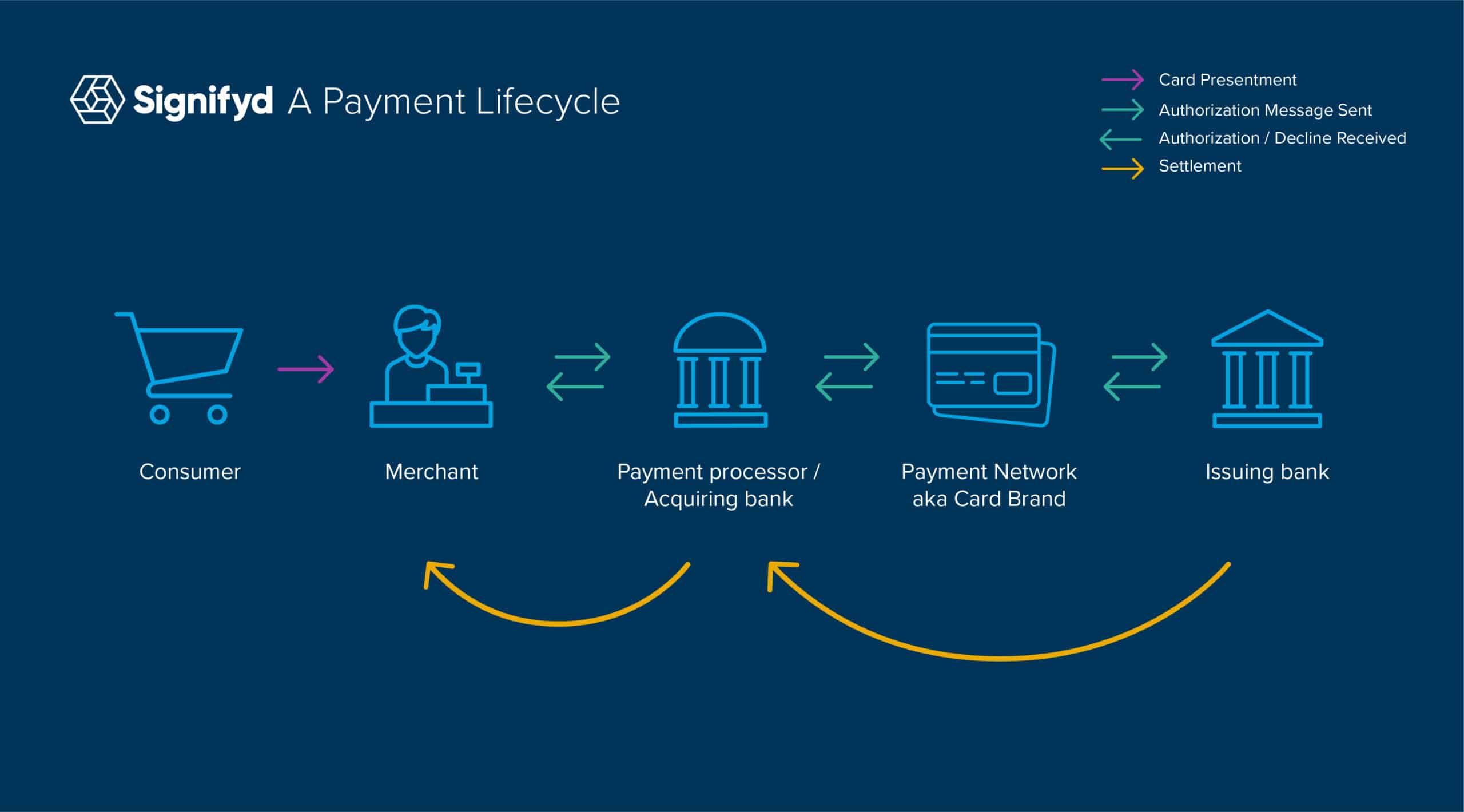

Maybe looking at the anatomy of a payment for an online purchase will help right about now. Here, the four key stages are authorization, batching, clearing and settlement, or funding.

Authorization: When a consumer presents their card (whatever their payment method of choice) or payment credentials to a merchant, that information is transmitted to the acquirer. That transaction is then passed to the payment network (Visa, Mastercard, etc.) and then on to the issuer. The issuer then decides whether that transaction should be approved or declined based on things like available balance and reviews for potential fraud or other illegal activity. Once the issuer has made its decision, it passes the decision — either an authorization or decline message — back to the payment network. The payment network then passes the message to the acquirer. The acquirer then communicates the authorization message or the decline message back to the merchant. Technology has made it so this entire process can occur extremely quickly — sometimes in less than a second.

Batching: At this stage, the merchant’s transactions are still “pending.” Batching is the process in which the merchant reviews and submits transactions to the acquiring bank. Traditionally merchants manually reviewed and submitted batches of transactions at the end of each business day, however, the process is becoming more and more automated.

Clearing: Each transaction in the batch from the previous step is then individually routed from the acquirer back to the payment networks, and then on to the issuers. The issuers then deduct the funds from the consumers’ accounts.

Settlement or funding: This is the final step of the transaction process and the point at which the merchant officially gets paid. In this step, the issuer transfers the funds it deducted from the consumer accounts to the merchant’s bank which then deposits the funds into the merchant’s account.

7) Other entities?

Ah yes, the alphabet soup of service providers: ISO, ISV and the aggregators, orchestrators, operators and marketplaces. Let’s start with the ISO.

ISO: An ISO, or “independent sales organization,” provides services to an acquirer in return for residuals.

Besides stepping in as an intermediary among the merchant and the payment processor and the acquirer, in many cases, the ISO also supplies the merchant with its point-of-sale (POS) system in a card-present environment or its gateway for a card-not-present environment. An ISO also generally acts as the main point of contact for the merchant if there is an issue with the merchant’s payment processing.

ISV: An ISV, or independent software vendor, provides solutions that aid in managing various business functions for merchants. Generally, when it comes to payments, this work involves developing integrated payment systems, which combine into one system things like a POS terminal, inventory tracking and employee time tracking. If you’ve ever worked in food service or retail you’ve probably used an integrated payments system.

Since the ISV is providing the payments system they will often step in as an intermediary between the merchant and the processor/acquirer, much like an ISO, and act as the point of contact if there are issues with the payment processing.

8) Payment facilitators

A payment facilitator, often referred to as a payfac or platform, is another type of service provider for merchants. A payfac provides the infrastructure a merchant needs to start accepting payments. They also simplify the merchant enrollment process.

Unlike the ISO model where the ISO sells the processor’s/acquirer’s services, but each merchant is underwritten and given their own merchant account, the payfac actually steps in to act as the merchant. It enters into an agreement with the processor/acquirer and is assigned a merchant ID (MID) like any other merchant.

The payfac then onboards other merchants as sub-merchants, allowing them to accept transactions which are then aggregated under the payfac’s MID.

To ease customer confusion, payfacs will leverage what is called a soft billing descriptor. If you’ve ever seen something like ABC*Ronscoffee on your account statement, it likely means that the merchant you shopped at is using a payfac and does not have their own direct merchant account. In this case ABC is an acronym assigned to the payfac, and what comes after the * is the name of the business you actually shopped at.

9) Payment aggregators

The rise of aggregators and orchestrators is the evolution of the payment facilitator model. Like a payfac, a payments aggregator steps in as the merchant, and onboards sub-merchants that all use the aggregator’s MID. However, the payments aggregator will have agreements in place with various processors/acquirers. This gives aggregators the ability to switch their sub-merchant’s transaction routing to optimize rates and acceptance.

Digital wallet operators

You’re probably familiar with digital wallets such as PayPal, GooglePay and ApplePay. They all get the job done, but not all digital wallets are created equal. They can be broken down into three categories.

What is a staged digital wallet?

PayPal is an example of a staged digital wallet. These digital wallets are the only types allowed to perform back-to-back funding transactions. Back-to-back funding means a merchant needs to be able to accept only the wallet in order to complete a transaction regardless of which payment brand’s credentials are attached to the wallet. They do this by funding the wallet from the credentials attached to the wallet in real time with the exact amount of funds being requested by the merchant.

What is a pass-through wallet?

GPay and ApplePay are examples of pass-through wallets. These wallets hold payment credentials from other payment brands. If you have a Visa card attached to a pass-through wallet, a merchant would need to accept Visa. In that case, the transaction taking place would be just like any other Visa transaction.

What is a stored-value wallet?

This type of wallet is basically a digital version of a prepaid card. A transaction must be initiated to transfer funds from a payment credential to the wallet.

10) Marketplace

A marketplace is like a payment facilitator in the sense that it steps in as the entity that has an agreement with the processor/acquirer. The marketplace then onboards merchants as sub-merchants that use the marketplace’s assigned MID. The difference is that the marketplace brings all those merchants together onto one single platform.

Amazon or Etsy are obvious examples of marketplaces. However, in recent years, several large retailers like Walmart have created their own marketplaces facilitating payments directly between sub-merchant vendors and consumers. You can read more about what this model looks like in Signifyd’s “The State of Commerce 2022” report.

No question, the process of paying and collecting payment online comes with a plethora of moving parts. Understanding them and the roles they play is the first step for retailers who want to analyze how their payment stacks function and where the potential lies for improved efficiency and economics.

The good news in the payments space is that no matter how many players are involved, it doesn’t take an act of Congress today to maximize the benefit your payment infrastructure brings to your business.

Looking to optimize your payment stack? We can help.