Last post we learned about what exactly is a merchant chargeback versus a refund and what is a regular chargeback automation procedure. Today we are going to dive a little deeper into handling chargebacks, discussing their legality, the industry average for chargebacks and differences and similarities of online payment chargeback orders.

What is the legality behind a chargeback?

Most everyone has seen the waiver issued by merchants when an individual partakes in any kind of semi-dangerous activity from swimming to skydiving that ask customers to sign a release form that frees them from legal liability, and thus from being sued should an accident occur by that customer. In the same manner, it would seem logical that many merchants might try to pass along a chargeback fraud types waiver to its merchants to protect themselves from later having money taken from them during a merchant dispute chargeback.

This however is illegal, as consumer protection acts over the years have cemented in law the ability for a consumer to obtain a refund of money from a business. There are two separate laws passed legalizing the ability for a consumer to begin the chargeback process, and they are split depending if the consumer paid with a debit card or a credit card.

The ‘Truth in Lending Act’, informally known as Regulation Z, is a stipulation in this 1968 piece of legislation that enables a consumer to challenge credit expenses on their bill and gives them the legal right to reverse a charge.

For debit purchases, Regulation E in the ‘Electronic Funds Transfer Act’ that was passed in 1978 gives consumers the right reverse charges by disputing debits from their accounts by their bank.

What is the industry average for a chargeback?

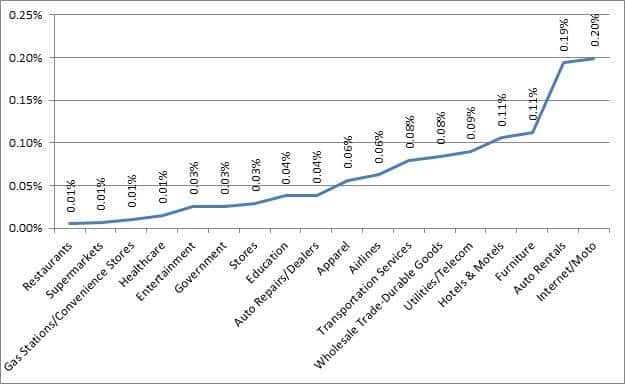

According to Optimized Payments consulting, the average chargeback rate varies depending upon your line of business. They created this nifty graph here in which we see that chargebacks average well below 1 percent throughout retail industries.

Of course, an average is just that. Some merchants face chargebacks well above average. As merchants start accruing 1 percent or above for chargebacks, we begin to see either higher margin industries/products or low levels of customer service or goods delivered.

Are all chargebacks the same?

It doesn’t take a rocket scientist to realize that chargebacks can easily be abused by consumers, but you can prevent chargebacks. While Regulation Z was setup to protect consumers from shifty businesses, fraud has become rampant among consumers looking to easily rip off businesses. There are different types of fraud and chargebacks for goods not received that businesses need to be on the lookout for to ensure that these legal protections afforded consumers aren’t abused against them.

Friendly Fraud

Though it’s name suggests that perhaps this is a type of accidental fraud, it is really anything but. Friendly fraud chargeback is defined as when a consumer makes a purchase, and then after the consumer has received the product from the merchant, attempts to have the charges removed from their bill.

Customer will not sign for delivery

Another instance of friendly fraud credit card arises during shipping. Requiring a customer to sign off on a delivery is standard for high end deliverables. Fraudsters knowing that a signature will complete a transaction cycle will often refuse to sign, then claim that they never received their product, all the while having possession of their purchase in the attempt to obtain a duplicate for free.

Digital Goods

Digital goods and services are an especially ripe area for consumers looking to rip off businesses. Because there is no shipping and the good is delivered immediately, a consumer (or fraudster) can make multiple purchases (checkout our section on velocity checks) and then call up a bank to claim that they were not the ones who authorized this transaction. Overlapping with friendly fraud, chargebacks are especially rife in virtual currencies as well as online social networks where children make unauthorized purchases on their parents credit cards.

Final thoughts

Regardless though of what type of chargeback a merchant is running up against, they need to ensure that they resolve the chargeback fraud and limit the number of chargebacks their company processes to as few as possible. While this might seem obvious to any merchant, the implications go simply beyond loss of revenue and product. In our next post, we will talk about the massive fees that a merchant can rack up from banks and card issuers if they cross the acceptable ‘chargeback limit’ for a month or year as well as how to fighting chargebacks. As always please reach out to us at [email protected] or at [email protected] if you have any questions.