Six months of pandemic, shelter-at-home and shutdown have dramatically altered consumers’ shopping behavior and sense of fair play in commerce, according to Signifyd’s holiday shopping survey in the United States and the United Kingdom.

The most startling finding, as the crucial holiday shopping season begins, is the significant increase in the number of online shoppers who told pollsters they have made false claims in order to obtain discounted products or full refunds for ecommerce orders that they kept.

The surprising admissions provide a warning for retailers as they head into an unprecedented holiday shopping season. This year, merchants need to be more prepared than ever to thoroughly analyze consumers’ chargebacks for goods not received. And they should be ready to dispute a significant portion of them. (A chargeback automation occurs when a consumer asks her or his credit card company for a refund because something didn’t go as promised.)

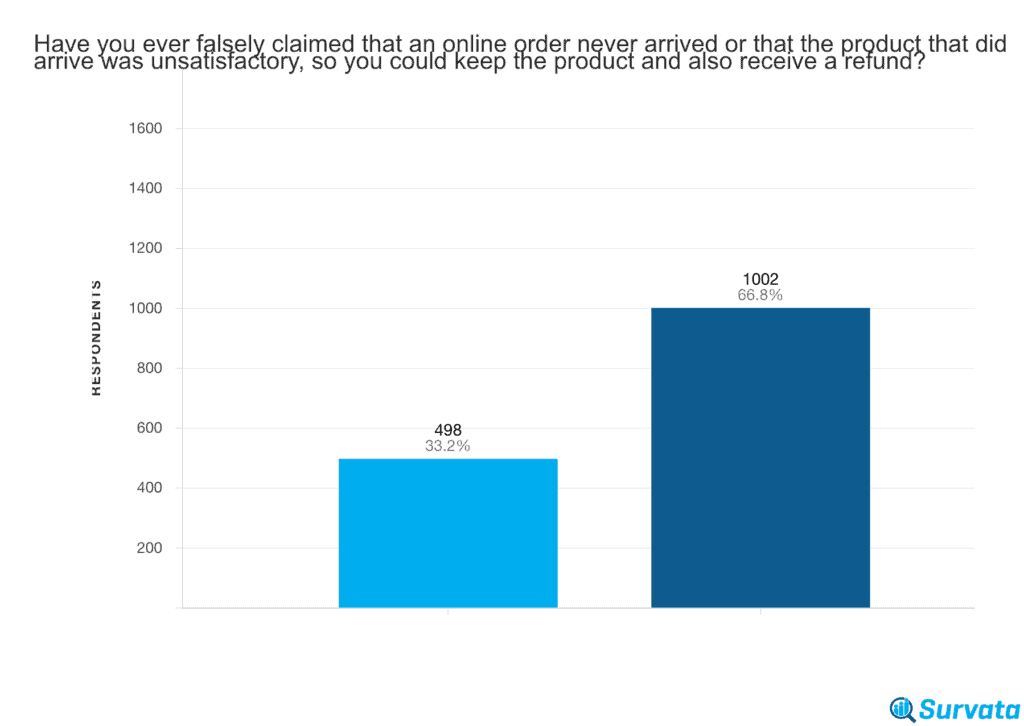

In the United States, more than a third of respondents admitted to falsely claiming either that an online order never arrived at their homes or that a satisfactory product was not satisfactory in order to keep the product and get a refund. More than 30% acknowledged breaking discount or promotion rules — for instance by using a “one-time-only” discount more than once.

33.2% of U.S. consumers reported filing false claims to obtain improper refunds on ecommerce orders.

The responses to the surveys conducted during the first two weeks of September were in sharp contrast to Signifyd’s pre-pandemic survey. In January, before the COVID-19 pandemic swept the country and the world, only 8.1% of consumers said that they had made a false claim that an ecommerce order was never delivered in order to keep the product and land a refund. Another 6% said that if they weren’t satisfied with something they ordered online, they’d keep the item and ask their credit card company for a refund.

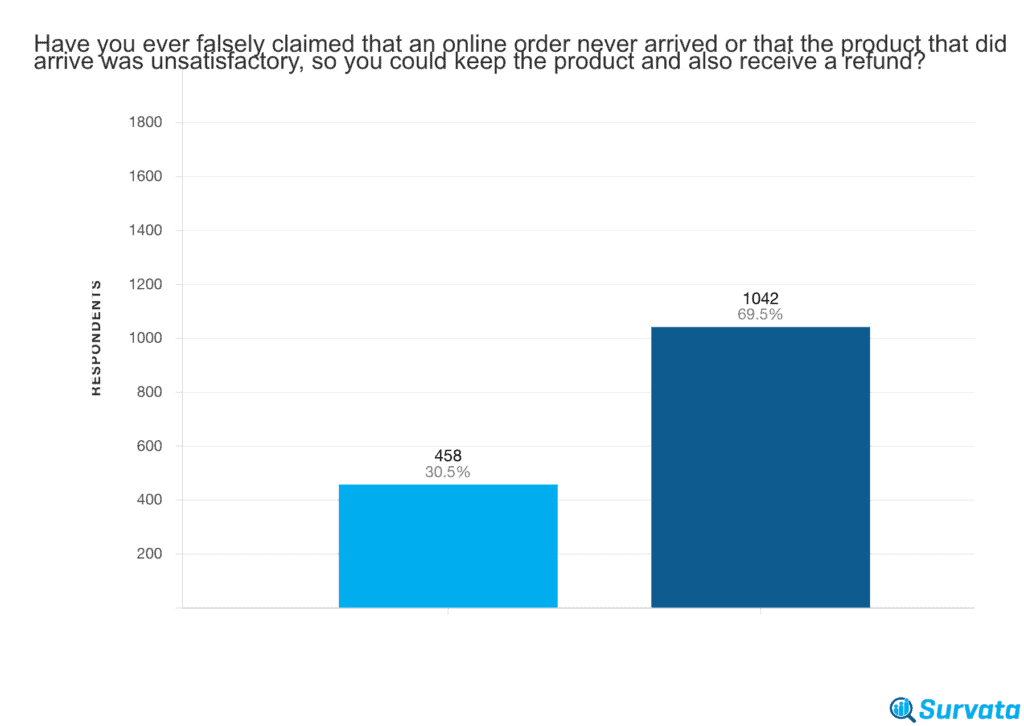

Nearly 36% of UK consumers commit friendly fraud regarding missing packages

Shoppers in the United Kingdom expressed a similar pandemic-era penchant for committing what is often referred to as “friendly fraud credit card.” Nearly 36% of UK consumers admitted to falsely reporting that they had not received an ecommerce package or that a satisfactory order was unsatisfactory in order to get a refund and keep the product they ordered. The separate UK survey found that 32.1% of respondents admitted to breaking discount or promotion rules in order to receive a price break they were not entitled to.

35.5% of UK consumers reported filing false claims to obtain improper refunds on ecommerce orders.

A significant number of consumers on both sides of the Atlantic also said they gamed the ecommerce system by seeking a refund for a legitimate claim on their credit card that they falsely claimed was a fraudulent charge.

In the U.S. 40.3% of consumers said they asked for a refund because of a fraudulent charge when in fact they knew no fraud had been committed. In the UK, the number was 36.1%.

- More than a third of consumers in both the United States and the United Kingdom admitted to filing false claims in order to get ecommerce orders for free, according to a Signifyd consumer survey.

- Nearly 80% of consumers in both geographies will avoid shopping in stores this holiday season — including significant numbers who will not shop in stores at all.

- Well over half of respondents in the U.S. and the UK say their incomes have been adversely affected by the COVID-19 pandemic and a similar percentage say they expect to take a financial hit in the coming year.

The reason for the spike in consumer abuse, sometimes called “friendly fraud chargeback” is not explicitly clear from the survey results. But the COVID-19 pandemic has created a complicated picture across criminal activity in general, with crime following new opportunities opened up by new ways of living.

For instance, a University of Pennsylvania study found that while residential crimes were down in some areas, because people are staying home, commercial crimes were up at a time when fewer people were at commercial businesses, the Miami Herald reported.

In the case of friendly chargeback, consider that residents of the U.S. and the UK are in the midst of an unprecedented health crisis. Joblessness is higher than it has been in generations and it is likely that many are simply being worn down by month after month of monotony and stress due to restrictions and procedures aimed at stemming the spread of COVID-19.

“We’ve been seeing friendly fraud increase a lot lately,” said Ryan Bermudez, Signifyd director of customer success, east. “I think the pandemic has caused a lot of hard times for a lot of people and that financial pressure seems to be leading to people’s moral compasses being recalibrated.”

Signifyd data shows that the number of friendly fraud online payment chargebacks filed for “item not received” have skyrocketed since the pandemic was declared in March. They were up 54% in September compared to January this year.

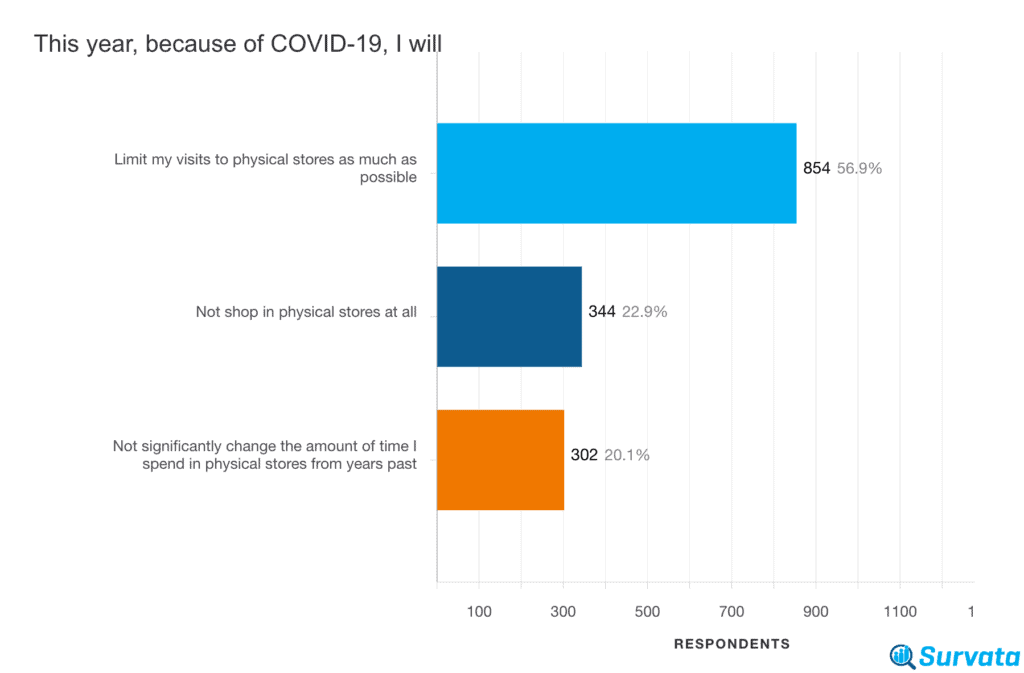

Consumers will avoid in-store shopping this year

The two surveys were conducted by market research firm Upwave, which polled 1,500 consumers in the U.S. and 1,500 consumers in the UK, between Sept. 3 and Sept. 16. Together, the surveys paint a picture of consumers who are concerned about their finances and worried about venturing into stores to shop — including during the upcoming holiday season.

Nearly 60% of U.S. respondents said their income has been adversely or very adversely affected by the COVID-19 pandemic and 59.5% said they worried about losing some or all of their income in the coming year.

The UK numbers were similar, with 53.9% saying their income had already been harmed by the pandemic and 55.2% saying they worried that they would lose all or some of their income in the coming year. Not surprisingly then, 66.7% of UK respondents said they would be spending less on holiday items this year compared to last year.

In the U.S, 60.4% of consumers said they would be spending less this year.

U.S. Results

Whatever money is actually spent during the 2020 holiday season, it will be much more likely to be spent online than in stores. In all, 77% of U.S. shoppers said they would avoid physical stores this holiday season, including 23% who said they would not visit stores at all.

In the UK, nearly 80% of consumers said they would either avoid stores as much as possible or not shop in stores at all. In all, 78.5% of UK respondents agreed that online shopping was safer than in-store shopping. In the U.S. 77.1% shared that view.

UK Results

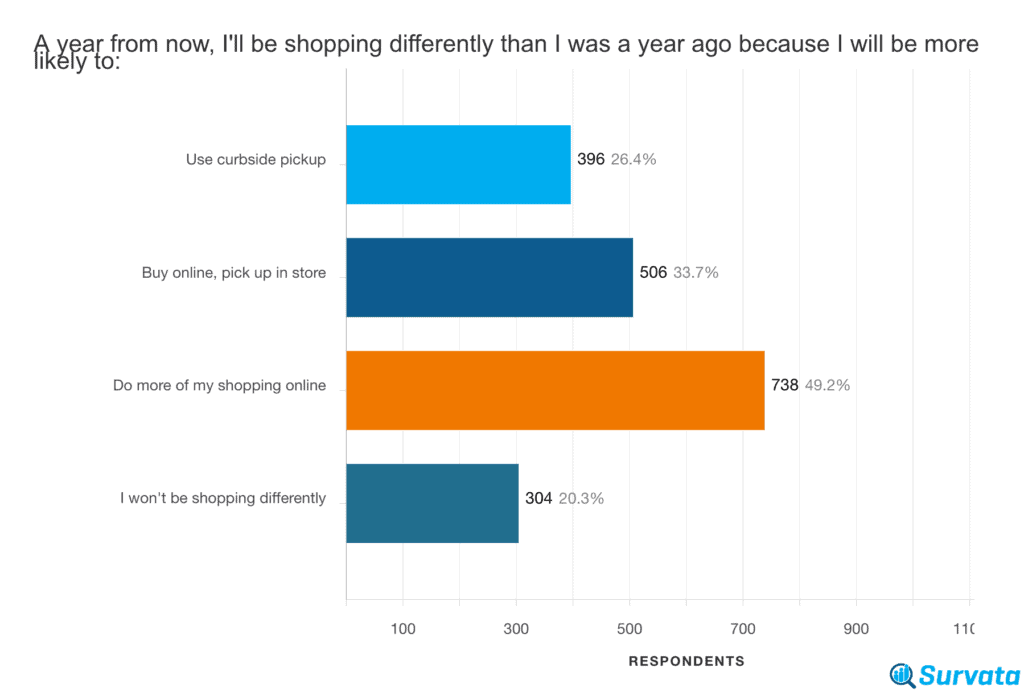

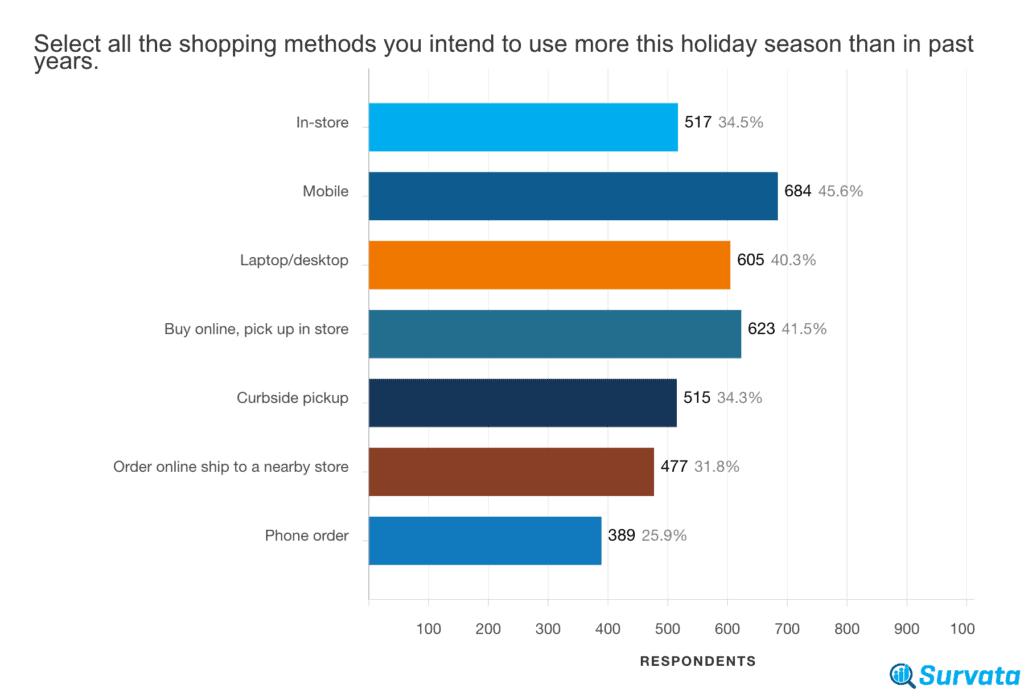

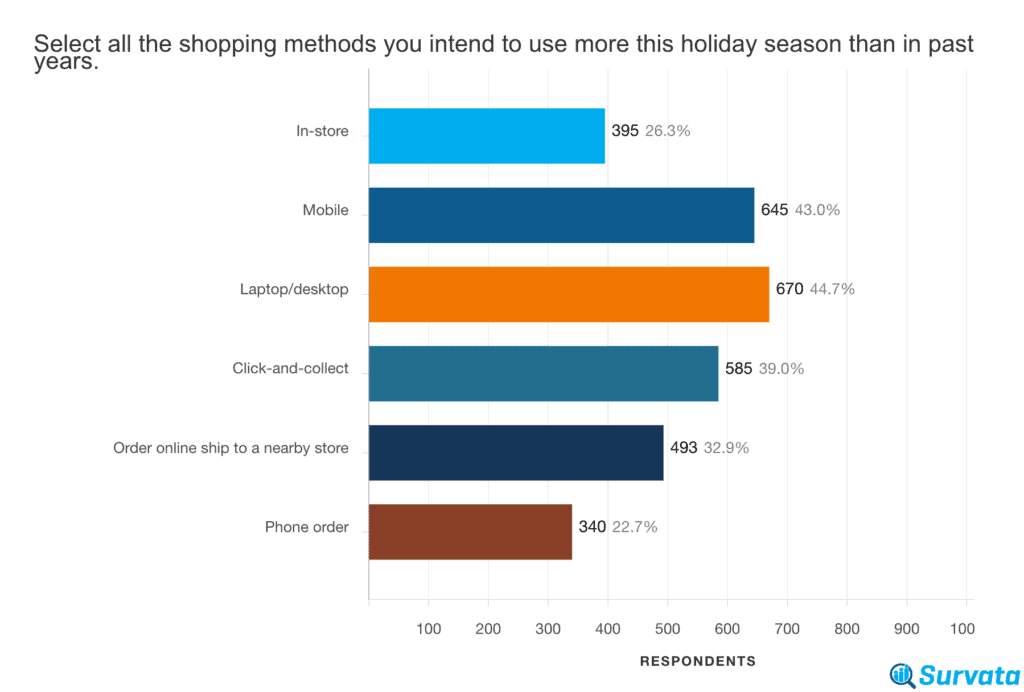

Consumers in both geographies will be replacing in-store shopping with online shopping, including curbside pickup and buy online, pick up in store, called click-and-collect in the UK.

U.S. Results

In the U.S, 41.5% plan to make greater use of buy online, pick up in store this holiday season and 34.3% expect to more often use curbside pickup. In the UK, where curbside pickup (click-to-car) is just beginning to gain serious traction, 39% of respondents said they would rely more on click-and-collect this holiday season compared to last year.

UK Results

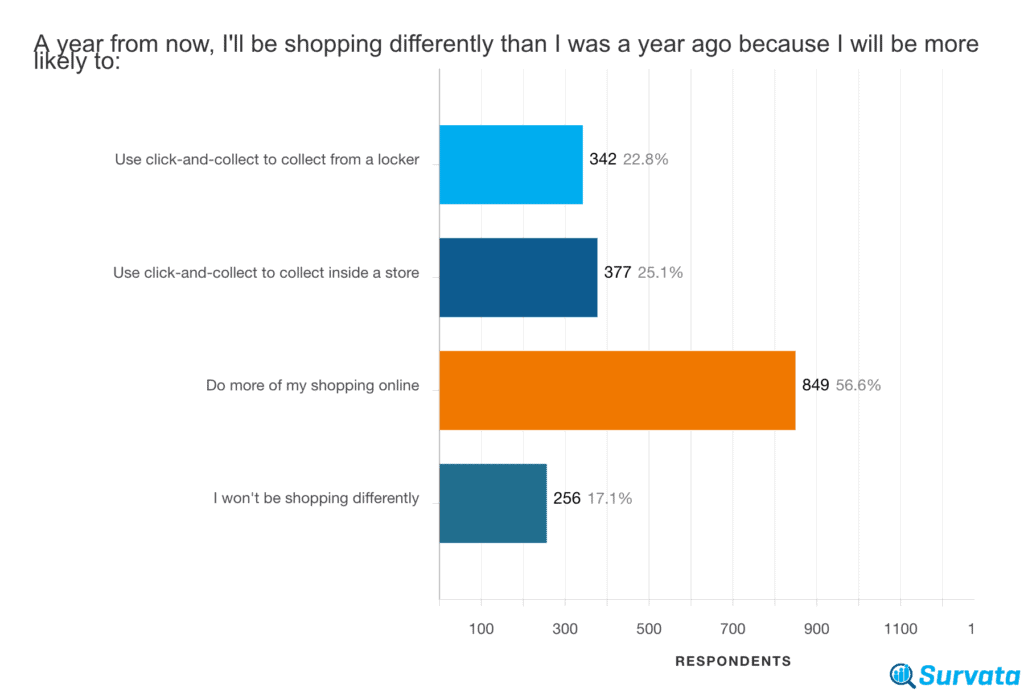

Consumers’ COVID-19 shopping habits are here to stay

And consumers in both geographies made it clear that these changes in behavior were not aimed at the short term. In the UK, 47.9% of respondents said a year from now they’d be shopping differently than they were a year ago, because they’d be relying more heavily on click-and-collect.

UK Results

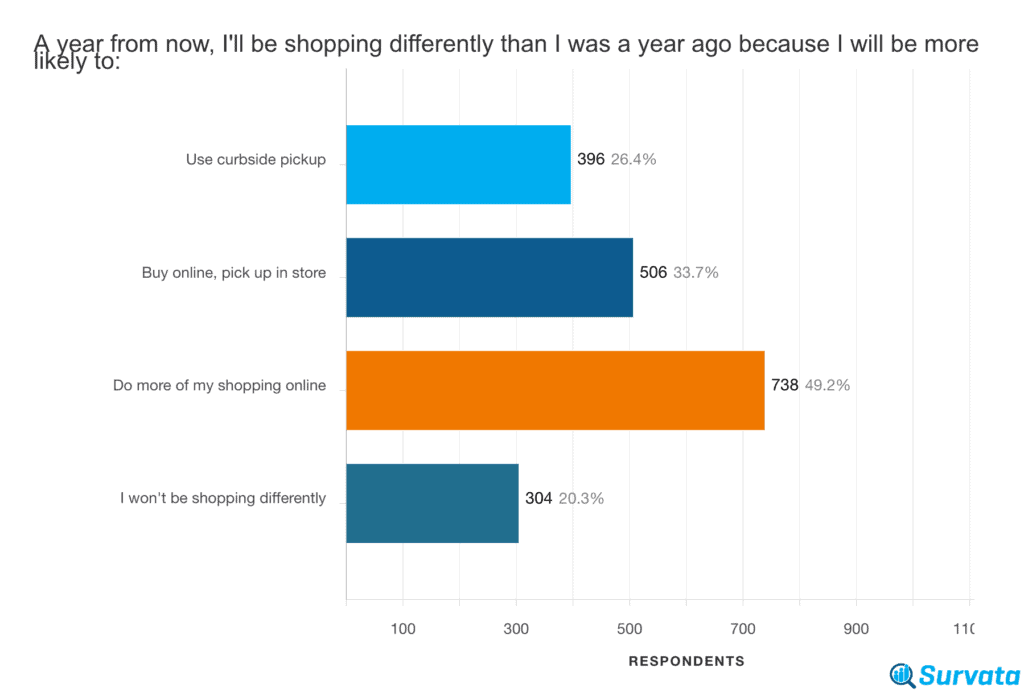

In the U.S., 60.1% said they expected to continue to more heavily use buy online, pick up in store or at the curb.

U.S. Results

The survey findings point the way for retailers who are expecting the holiday shopping season to begin exceptionally early this year. Amazon has set Oct. 13 and 14 as its annual Prime Day promotion, which likely will become a focus of holiday shopping. Another group of retail industry leaders is promoting a 10.10 shopping holiday inspired by Alibaba’s Singles Day on Nov. 11, to kick off holiday shopping.

Retailers are even more anxious than usual to get consumers to start shopping because they are concerned that the massive increase in ecommerce brought on by the pandemic will only escalate during the holiday season and may overburden fulfillment operations.

Furthermore, FedEX, UPS and the United States Postal Service have all imposed surcharges for high-volume shippers during the holiday period. Retailers are hoping to minimize those surcharges by spreading their shipments out over a longer holiday season.

Given consumers’ expressed preferences, then, retailers will want to be prepared for dramatic spikes in online orders — beyond what they’ve been seeing during the pandemic. They will also want to have their buy online, pick up in store, click-and-collect and curbside programs well organized and ready to scale.

The surveys also highlight a growing trend. Payment fraud has always been a challenge. That flavor of fraud generally occurs when a professional fraudster or ring makes unauthorized use of a consumer’s identity, credit card or account. Recently, merchants have been plagued by fraud schemes beyond the realm of unauthorized fraud and often conducted by everyday consumers. We’ve seen this, for instance, with return fraud. And, of course, with friendly fraud, which appears to be on the rise.

In light of the surveys’ findings that more consumers are admitting to filing false claims, retailers will want to assess their fraud protection and consumer abuse prevention systems to ensure that they can keep up with the rapid increase in orders and the potential increase in orders from bad actors.

Friendly fraud in the holiday season can be stopped

Signifyd customers have already taken steps to protect themselves with Signifyd’s Commerce Protection Platform. The platform uses machine learning and data from its Commerce Network of thousands of retailers to instantaneously sift fraudulent orders from legitimate ones. Its Abuse Prevention solution automates chargeback management and offers a financial guarantee for non-fraud-related chargebacks that complements Signifyd’s fraud chargeback guarantee.

There has been little doubt for sometime that holiday 2020 would be unlike any holiday shopping season that has come before. But the ways in which it will different are becoming more evident as the voice of the pandemic-era shopper is becoming more clear.

Photo by Getty Images

We can help with friendly fraud chargebacks and with building curbside and pick-up-in-store programs that protect you from fraud.