Retail chief financial officers (CFOs) are breathing tentative sighs of relief now that the worst of the COVID-19 lockdowns appear finally behind us. With stores reopening, and consumers coming out of their homes to attempt resuming normal lives, CFOs are cautiously optimistic that they’ve made it through the worst and that new ecommerce trends will prevail.

It doesn’t mean that things will ever be the same, however. 2020 is likely to have a permanent impact on how CFOs run companies. Ecommerce is now established as a vital channel for maximizing sales, even as brick-and-mortar stores open again. Now is the time to automate the back office to cut costs and increase efficiencies for true omnichannel operations; build more resilient supply chains so that retailers will be protected should another global event disrupt traditional ways of assuring a steady flow of goods; and invest in security and anti-fraud measures now that a significant proportion of sales are online, where merchants are liable for fraud costs.

- The world of commerce has shifted dramatically in ways that are particularly important to retail finance leaders.

- Customers have embraced new habits in the time of COVID-19 — and those habits are here to stay.

- This post lays out five new ecommerce trends that finance leaders should pay particular attention to.

Signifyd’s recently released “State of Commerce Report 2021: Redefining Experiences for a New Wave of Customers,” concluded that although it’s too early to say for sure whether these new consumer habits will continue with the same zeal, retailers should study the trends and use them to (tentatively) plan moves that will carry them successfully into the new, post-COVID-19 world. Here are five trends in particular that CFOs should keep their eyes on:

1. Devote attention to—and investment in—ecommerce operations

Ecommerce, once just a small slice of retail revenue, now adds up to as much as 30% of it. This trend is only expected to accelerate in the next 12 months. Signifyd estimates that the pandemic sped up the expected transition from physical to online sales by at least five years. The implications for CFOs are enormous. Capital investments need to be made in distribution operations more suitable to shipping goods all over the country—or the world. Personnel costs will shift from in-store to behind-the-scenes processing of orders and automation—both traditional robots for warehouses and software robots (bots) for automating digital processes—will come to the forefront as a way to save costs and improve profitability.

2. Invest in store and personnel accommodations that support buy-online-pick-up-in-store and curbside pickup

During early phases of the lockdown, non-essential retailers had no choice. They weren’t allowed to let shoppers into stores. So curbside pickup became a necessity. Today close to half of the Digital Commerce 360 Top 500 retailers offer curbside pickup. (Before COVID-19 hit, it was less than 7%).

Finance leaders are obviously involved in such a massive shift. Stores have to be redesigned and personnel trained to accommodate this new way of getting products to customers. Investments have to be made in new systems that use advanced technologies like AI and ML to ensure that the right products are available in the right stores when needed.

This isn’t an easy strategy to embrace, because the logistics are difficult. Plus, these kinds of operations offer many opportunities to be exploited by fraudsters. Still, Best Buy, after closing all its physical stores, converted them to curbside pickup and delivery fulfillment centers within 48 hours, CNN reported. That way, the stores continued to generate revenues even in the midst of the most severe lockdowns. That’s quite a feat.

3. Put money into building systems that drive experience excellence for online newbies

The pandemic did offer some benefits. Large numbers of new customers clicked their way into online storefronts without retailers having to spend lavishly to acquire them. The challenge became to turn them into loyal customers with high lifetime value. This meant focusing on the customer experience. CFOs will be asked to fund a number of critical new IT initiatives, such as building (or buying) AI-based recommendations engines to cross-sell and upsell new customers, and updating store search and shopping-cart systems so that they’re easy to navigate. Do it. The ROI will be worth it.

Interestingly, these new online consumers behaved differently from those who came before them. As a group, they had larger basket sizes than those who had been serious online shoppers for a couple of years, spending more than their 2019 peers by about 6%. They were also the most enthusiastic buy-online-pick-up-in-store (BOPIS) buy online pickup in store and curbside shoppers.

But as with all new customers, retailers have to work hard to deliver the right kind of experience to get these consumers to come back. They are in that super-sensitive first-impression territory. For example, products need to be dispatched on time and curbside orders had better be ready when promised. First impressions mean a lot, especially when you are attracting and retaining customers solely through digital channels. This means spending the money needed to build the right kind of infrastructure — physical, operational, and technical — to support these activities.

4. Maximize revenues while minimizing fraud

Retailers who had little to no experience with online sales prior to COVID-19, faced a dilemma. Card not present fraud is riskier than taking a credit card from a shopper in your physical store. Increases in online orders are inevitably accompanied by increases in fraud. When COVID-19 arrived in full force in March 2020, fraud rings were right behind them, knowing that traditional fraud teams were likely working from home and stretched thin.

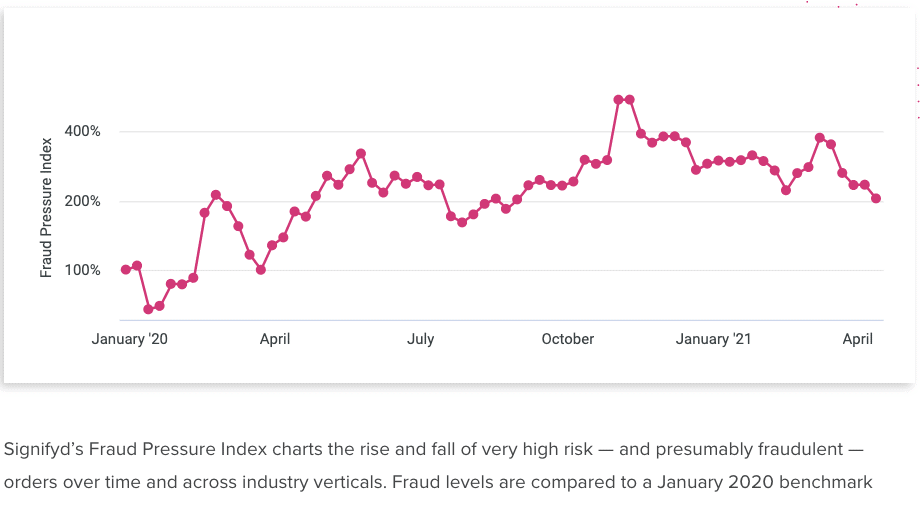

Signifyd posts a running Fraud Pressure Index to determine how much online fraud is occurring at specific points in time. That index broke all records during the pandemic. By the end of May 2020, fraudulent activity rose more than 320% compared to pre-pandemic levels. Although these levels continued to fluctuate for several months, in the early holiday shopping season, it reached heights more than six times pre-pandemic levels.

Unfortunately, new — and even experienced — online retailers saw these trends and shrank back. They became more conservative about which orders they would approve. This put a damper on revenues, as a lot of legitimate orders were refused. Retailers need to take a more balanced view of fraud, and find ways to mitigate losses without turning away potentially valuable customers. This impacts CFOs directly because too-stringent anti-fraud measures can inhibit bottom-line sales and top-line revenue.

5. Keep an eye on your customers, too

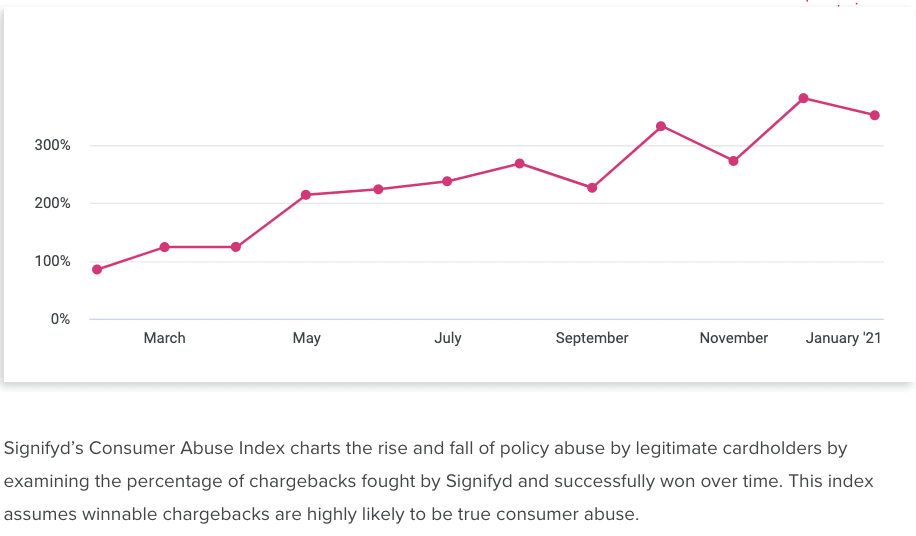

CFOs also need to be aware of one trend that was startling in its brazenness – because consumers actually told Signifyd they were doing it: an increase in consumers lying to get free or discounted products. Signifyd’s Consumer Abuse Index ended 2020 five times higher than what it was before the pandemic. Consumer abuse typically occurs when a customer claims a legitimate charge was fraudulent, or that an online order that did arrive never arrived, or that a perfectly good item was received in unacceptable condition. A consumer makes such claims by filing a chargeback, which is designed to result in a refund of the purchase from the merchant.

In a Signifyd survey, 40% of consumers said they’d falsely claimed that a legitimate charge on their credit card was fraudulent. And more than 33% said they claimed an order that had arrived in good condition either hadn’t arrived at all or arrived in unacceptable condition — all to receive a refund while keeping the product. CFOs need to be alert to this type of inventory “shrinkage” as it inevitably affects profitability and revenue.

Freelance writer Alice LaPlante, an award-winning author, contributed to this post.

Talk to us about how to leverage the new ecommerce trends