“Can I get a refund?” – A question that no retailer wants to hear, the automatic guarantee of a refund by a merchant has become ingrained into 21st century America. From expensive jewelry to small ticket items, purchased in person or over the web, the ability to return goods to merchants in exchange for a customer’s money back goes almost unquestioned. But many merchants do not wish to offer refunds over frustrations of the costs involved. When a customer cannot obtain a refund directly from a merchant, they begin the process called a chargeback automation. In a perfect business world there would be no refunds, no chargebacks. But we are inhabitants of an imperfect world working in an imperfect marketplace, and online payment chargebacks happen all the time. Why they happen, how they happen and what to do about it is going to be covered in this three part series.

Chargebacks vs. Refunds Defined

What is chargeback vs. refund, and how do these two differ? To answer this question, we first need describe what a refund is and then define a chargeback fraud types. A refund is a remittance of funds from a merchant to customer most commonly defined as the returning of cash from a merchant in exchange for the return of goods by the consumer. A refund can be for any purpose, from non-shipment of goods to a defect in the product. But regardless of why a refund is initiated, it is always between the business and its customer.

A merchant chargeback by nature is a far less desirable route for a merchant in an already frustrating ordeal. A chargeback is defined as when a consumer contacts its credit card company or bank to complain about a merchant and ask the credit card company or bank to issue them a refund directly. If a refund is issued by the credit card company or bank to the consumer, the funds are forcibly taken from the merchant. To add insult to injury, the merchant is then hit with a chargeback fee on top of the lost goods by the merchant.

What customers don’t know is after their 3rd chargeback they get counterfeit cash

What is the chargeback process?

Before we continue with more definitions of what is and is not a chargeback, laying out exactly what the chargeback procedure steps are is an important development. On average, a chargeback has about 6 to 8 different steps on its path from customer initiation to bank/merchant resolution. Below is a well written chargeback path from the website Dalpay.com that helps illustrate how the typical chargeback develops.

Step 1: The cardholder files a complaint by contacting his or her issuing bank about the erroneous transaction.

Step 2: The issuing bank checks whether the dispute is valid. If the bank finds the request invalid, the dispute is simply declined and the customer is charged with a processing fee.

Step 3: If the issuing bank sees a potential error, a provisional credit is provided to the cardholder. The bank then initiates the usual chargeback process, to obtain credit from the merchant’s sponsoring bank.

Step 4: The merchant bank sponsoring the account then checks whether the chargeback fraud detection is valid or not. They usually send you a notification to inform you of a pending chargeback request.

Step 5: The merchant’s sponsoring bank then does some research on the validity of the chargeback claim. If the chargeback is found to be invalid, they will decline said chargeback and inform the card-issuing bank.

Step 6: Assuming the chargeback is invalid, the amount of the chargeback is removed from the merchant’s account and the merchant’s bank will notify the merchant about the outcome.

Step 7: If a processing error has indeed occurred, the corresponding correction is then sent to the card-issuing bank for re-presentation.

Step 8: The merchant will be asked to provide the needed documentation and proof to remedy the chargeback. If the documentation provided is satisfactory, the claim for chargeback is denied and the customer will be charged once again for the sale. If the documents seem to be unsatisfactory, the chargeback amount will be provided to the customer.

What is the legality behind a chargeback?

Most everyone has seen the waiver issued by merchants when an individual partakes in any kind of semi-dangerous activity from swimming to skydiving that ask customers to sign a release form that frees them from legal liability, and thus from being sued should an accident occur by that customer. In the same manner, it would seem logical that many merchants might try to pass along a type of chargeback waiver to its merchants to protect themselves from later having money taken from them during a chargeback.

This however is illegal, as consumer protection acts over the years have cemented in law the ability for a consumer to obtain a refund of money from a business. There are two separate laws passed legalizing the ability for a consumer to begin the chargeback process, and they are split depending if the consumer paid with a debit card or a credit card.

The ‘Truth in Lending Act’, informally known as Regulation Z, is a stipulation in this 1968 piece of legislation that enables a consumer to challenge credit expenses on their bill and gives them the legal right to reverse a charge.

For debit purchases, Regulation E in the ‘Electronic Funds Transfer Act’ that was passed in 1978 gives consumers the right reverse charges by disputing debits from their accounts by their bank.

What is the industry average for a chargeback?

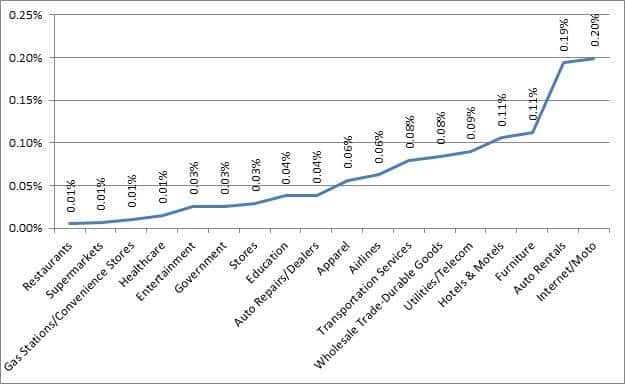

According to Optimized Payments consulting, the average chargeback rate varies depending upon your line of business. They created this nifty graph here in which we see that a chargeback rate under 1% is good by industry standards.

A standard chargeback rate of around 1% is the median across all industries. As merchants start accruing 1% or above for chargebacks for goods not received, we begin to see either higher margin industries/products or low levels of customer service or goods delivered.

Are all chargebacks the same?

It doesn’t take a rocket scientist to realize that chargebacks can easily be abused by consumers. While Regulation Z was setup to protect consumers from shifty businesses, fraud has become rampant among consumers looking to easily rip off businesses. There are different types of fraud and chargebacks that businesses need to be on the lookout for to ensure that these legal protections afforded consumers aren’t abused against them.

- Friendly Fraud

Though its name suggests that perhaps this is a type of accidental fraud, it is really anything but. Friendly fraud is defined as when a consumer makes a purchase, and then after the consumer has received the product from the merchant, attempts to have the charges removed from their bill.

- Customer will not sign for delivery.

Another instance of friendly fraud credit card arises during shipping. Requiring a customer to sign off on a delivery is standard for high end deliverables. Fraudsters knowing that a signature will complete a transaction cycle will often refuse to sign, then claim that they never received their product, all the while having possession of their purchase in the attempt to obtain a duplicate for free.

- Digital Goods

Digital goods and services are an especially ripe area for consumers looking to rip off businesses. Because there is no shipping and the good is delivered immediately, a consumer (or fraudster) can make multiple purchases (checkout our section on velocity checks) and then call up a bank to claim that they were not the ones who authorized this transaction. (Friendly fraud vs chargeback fraud) Overlapping with friendly fraud chargeback, abuse are especially rife in virtual currencies as well as online social networks where children make unauthorized purchases on their parents’ credit cards.

Do merchants get banned for too many chargebacks?

For consumer protection, every card issuer has their own chargeback monitoring program. These are the links for the Visa chargeback program as well as the link for MasterCard’s. For a comparison of the two programs this pdf helps to show the differences between the two .

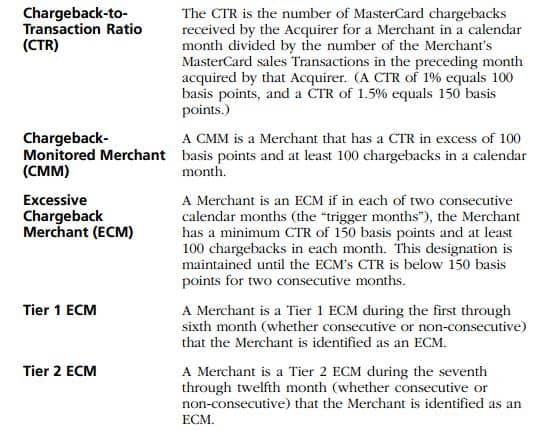

The answer though to the question above is an absolute yes. According to Chargebacks.com, 1% is a merchant industry maximum for card issuers when it comes to handling chargebacks. In a snipit from the attached MasterCard document, one can see how MasterCard tracks and defines it’s merchants applying different categories to them based upon the volume and the longevity of their chargebacks.

If a merchant stays above 1%, they will enter into the world of the above chargeback prevention services.

If a merchant during this time either fails to bring their chargeback rate down or is unable to successfully dispute and win chargebacks against them a card issuer will terminate their relationship with a merchant.

Excessive dorm room prep shopping accounts for 35% of all chargebacks

Do merchants get hit with fee’s for multiple chargebacks?

The first time a merchant gets hit with a chargeback, the fee can vary depending on the credit card processor. PayPal charges $20, Stripe charges $15 and Google Checkout will charge $10.

According to chargefellow.com, the average credit card chargeback fee ranges between $5 to $15 dollars, and this fee is paid regardless if the merchant dispute chargeback or not. The real pain comes if a merchant is placed in their chargeback monitoring program. $5,000 dollars is the fee for being inducted into this dubious club, with high levies based upon chargeback volume.

Do the banks ever side with the merchants?

Banks can side with merchants, but be prepared to work for your money. The burden of proof lies on the business, not on the consumer, to prove that they should keep their revenue. According to paymentsviews.com, the process of re-reversing a chargeback which is task known as a retrieval request only happens 10% to 15% of the time. This goes to show the uphill battle merchants face when battling the banks who themselves do not wish to lose any customers. The key to all of this is precise documentation of every order, which increases the likelihood of winning a dispute charge with a bank.

After one chargeback, can I block customers from future transactions?

The answer to this is yes, online retailers can block customers. In what is known as merchant deny lists, online retailers can add a customer’s name to an internal list to block future transactions listed by that individual. Many merchants prevent costly chargebacks by allowing only one chargeback per customer, and subsequently placing that customer on a deny list which bans them from shopping on their site. Many more merchants will ban a customer for life after a single chargeback. Some merchants go even further and will purchase industry deny lists of customers who have initiated a chargeback claim against another merchant to block that customer altogether from making a purchase.

How do I prevent chargebacks?

The answer is easy but can be time consuming without tools like Signifyd to help your company. Merchants need to screen every transaction to ensure that they are not about to process an order for a high risk customer. Previously, merchants would screen their questionable orders by manually calling up a customer to verify their identity and that they have the card in hand. This would go a long way in stopping a fraudulent transaction plus a chargeback. But there is only so much information a person can extract from a quick phone call. Signifyd can pull complete customer profiles for every order that passes through your system. This includes checking the email, phone number, billing and shipping addresses as well as their credit/debit card for any chargebacks the customer may have initiated in the past. With Signifyd’s complete order verification service, merchants worried about chargebacks can simply pass their orders into our system and instantly be advised as to whether they should accept or decline an order as well as an explanation behind that decision. If you have any specific questions about chargebacks, fraud prevention or how Signifyd works please reach out to us via our support portal or email [email protected]. Thanks for reading!