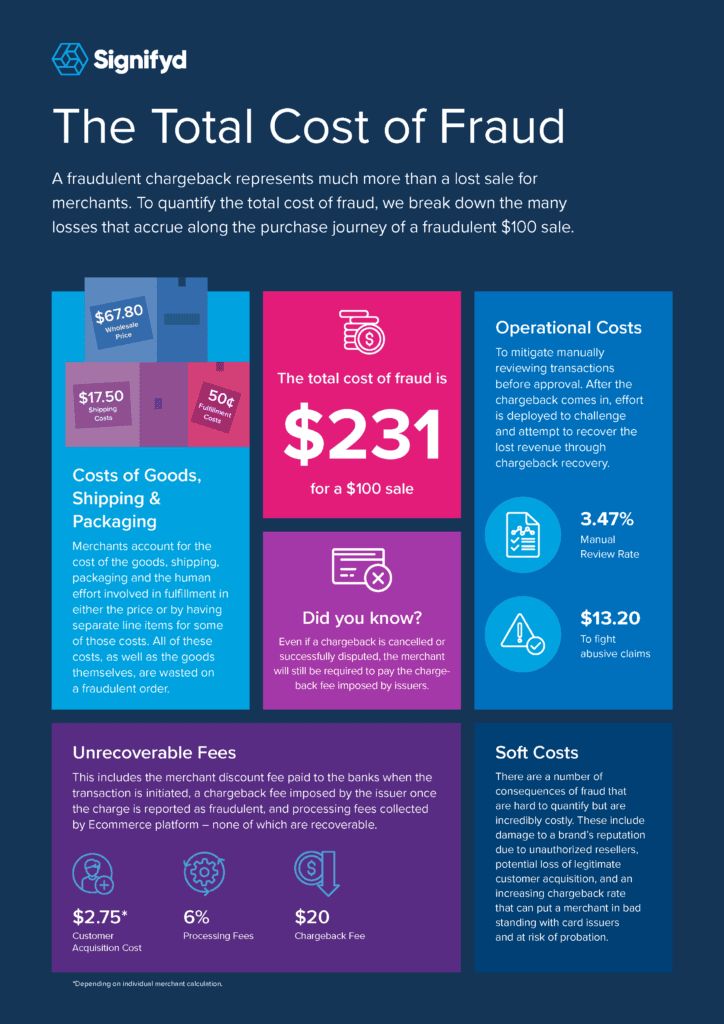

Are fraudulent orders just a cost of doing business? If so, that cost may be more than it appears at first glance.

Merchants spend more money on a sale than just the cost of the goods purchased: It costs money to acquire customers, for example, as well as to fulfill orders, accept a credit card payment and perform manual reviews of orders in an effort to cut down on fraud.

When fraud is involved, not only does the merchant not recover the costs to pay for these typical expenses – there are extra costs that stem from the fraud itself. The total cost of fraud includes chargeback fees, for example, as well as the cost of trying to recover the chargeback abuse.

What does the total cost of fraud look like?

Lost revenue is painful; lost opportunity is crushing

A fraudulent order is a waste of both money and opportunity.

Let’s say a fraudster steals a credit card, taking over a consumer’s account or using the number to make up a new identity. The merchant where the fraudster will use that card number may start losing money before a purchase is even made, when the fraudster identifies the target merchant by clicking on ads — wasting the money the merchant has paid to attract buyers.

When it comes to the actual sale, the merchant pays for the item that is purchased — in our example, a shirt that the merchant acquires for $67.80 and resells for $100. The fraudster orders the shirt, agreeing to pay the $100. When the transaction is initiated, the merchant pays a percentage of the retail price in fees. Because the merchant is trying to protect itself from fraud, it may also pay employees to perform a manual review of transactions. Next, the merchant pays to package and ship the shirt to the fraudster.

Now the fraud is uncovered: The fraudster has the shirt, but the person whose credit card was charged has discovered the problem, and the credit card company takes the $100 back from the merchant – plus more, in the form of a chargeback fee. If the merchant wants to dispute the chargeback, it has to pay a dispute team to gather information about the transaction.

The fraudulent transaction also has less quantifiable costs, from damage to the merchant’s reputation to potential problems with payment processors.

Grab your calculator and your antacid

A study by Signifyd took a close look at all the times money changes hands during a fraudulent transaction — and estimated the total cost of fraud at $231 for a fraudulent $100 sale. A word about our analysis: Naturally, some of the cost figures vary merchant by merchant and by vertical and product.

In some cases we’ve relied on industry averages or on charges that are common or typical in the real world. The general arc of the story, however, is accurate: The cost of fraud goes well beyond the value of the item that is stolen.

The costs — in addition to the $100, which the merchant receives but then has to pay back — fall into four broad categories:

Cost of goods, shipping and packaging

In the case of the $100 shirt purchase, the merchant loses the money spent on shipping, packaging, the human effort involved in fulfillment and the shirt itself:

- $67.80 wholesale cost

- $ 17.50 shipping costs

We used the median shipping and fulfillment cost based on a wide industry range. Shopify merchants can calculate more precise fulfillment and shipping costs based on their particular business operations.

All these charges and costs are wasted when the order is fraudulent — plus the shirt is no longer available for a real customer to buy. So, forget that sale. Worse yet? A potential customer may end up shopping elsewhere if the shirt they wanted is out of stock. And that customer may have just found their new favorite place to buy shirts.

A system that declines fraudulent transactions before they happen can prevent these losses – and ensure that when merchants spend money in these areas, it’s for legitimate transactions.

Signifyd customers, for example, rely on its Commerce Protection Platform to differentiate between fraudulent and legitimate orders through the use of big data and machine learning. Signifyd also makes retailers whole for approved orders that turn out to be fraudulent. More importantly, the Commerce Protection Platform recognizes legitimate orders, ensuring that good customers are not turned away — helping preserve and grow customer lifetime value.

Operational costs

Fighting fraud also costs money:

- About $3.50 for manual review of transactions

- $20 chargeback fee

- $13.20 to challenge the chargeback

Merchants may have staff manually review transactions, at an estimated cost of 3.47% of the purchase price – or about $3.50 for a $100 shirt.

This has a number of disadvantages: It requires hiring and training staff to do the work, and it can also make processing orders take longer. When legitimate customers encounter delays in processing because of these reviews, they may be more likely to cancel orders or not order from the merchant in the future. In addition, if manual reviews weren’t necessary, or were done less frequently, more staff time could be spent on projects that help build the business.

Challenging abusive online payment chargebacks can help recover some lost revenue — but it also requires staff time and training.

Unrecoverable fees

All transactions include some costs — for customer acquisition and processing, for example. And none of these can be recovered even if the purchase turns out not to be legitimate:

- $2.75 customer acquisition cost, a partial figure accounting for

- About $6 processing fees

Finding a customer – even a fraudster, potentially – costs money for advertising: the customer acquisition cost. And, of course, should fraudsters actually click on your digital ads, they’re skewing the marketing insights those clicks provide. Each transaction generates processing fees, such as those paid to the ecommerce platform that handles the transaction, as well as the merchant discount fee paid to the bank when the transaction is initiated.

And when the fraud is discovered and the owner of the credit card whose number was used refuses to pay, the card issuer not only takes back the payment – it collects a chargeback fee. Even if a chargeback for goods not received is canceled or successfully disputed, the merchant still has to pay the chargeback fee.

The best defense against these unrecoverable charges: a system that can stop fraudulent transactions before they happen. This prevents chargeback fees and ensures that the other fees are going toward true sales. Signifyd’s online fraud prevention solutions, for instance, provide automated chargeback recovery services and extends its chargeback guarantee.

Soft costs

Fraud comes with other costs, too, which are difficult to quantify but important nonetheless.

The brand’s reputation may take a hit when a legitimate consumer is taken advantage of by a fraudster. The consumer – and others – may blame the merchant for the fraud. If the stolen goods are resold by unauthorized retailers, that can lead to additional reputational damage.

Once fraudsters see that a particular merchant is a good target, word may spread – leading to more fraud and more costs. There is even the potential, if merchants are seeing too many chargebacks, that payment processors and banks may refuse to process the retailer’s transactions.

Finally, the total cost of fraud includes the lost opportunity: Instead of paying for a fraudster to click through an ad and going through the effort and expense of sending the shirt off to someone who isn’t a real customer, the merchant could have spent that advertising money and all the good money after bad on a true customer, helping to build a loyal customer base.

This blog post was updated on March 4, 2025. Mike Cassidy contributed to the update.

Photos by Getty Images

Want to eliminate your cost of fraud? Let’s talk.