As the threat of the coronavirus recedes in parts of Europe and in-store shopping becomes a thing again, ecommerce continues to perform near historic highs.

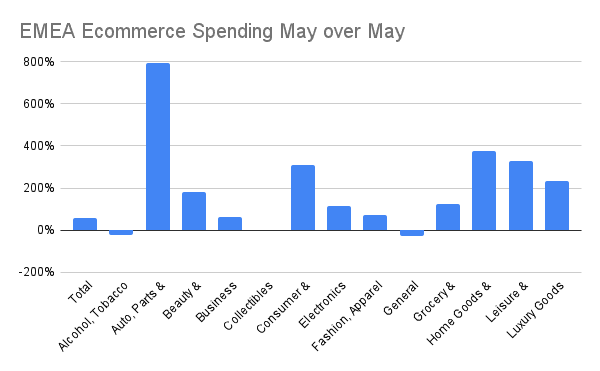

Overall online sales in Europe were up 55% in May compared to May 2020, a time when the grave depths of the pandemic were becoming evident. The continued increase in ecommerce, seen in Signify’s Ecommerce Pulse data, might come as a slight surprise, given the assumption that pent-up demand would send consumers rushing back to physical stores.

- Ecommerce remains strong across Europe, even as stores re-open

- Europeans are spending big on verticals that presage a reopening — luxury goods, cosmetics, jewelry and autos.

- High streets and shopping districts are on the rebound, but progress has been uneven across Europe’s cities.

The continued enthusiasm for ecommerce, though, is likely an indication that shoppers are sticking with the habits they formed during the pandemic when stores were closed for a time and many were uncomfortable venturing in even when they were open.

Physical retail’s return has been uneven across Europe

The continued ecommerce growth could also be a function of the fact that while shoppers are returning to high streets and shopping districts in the UK and across Europe, the rebound has been uneven and has not brought back nearly as many shoppers as once roamed retail hubs. A Vogue Business analysis of shopping traffic based on Google COVID-19 Community Mobility data shows many cities have a ways to go to reach pre-pandemic shopping levels.

Of the major cities Vogue reported on, London’s retail was still suffering, though activity in England’s capital was up 42% since February. Paris and Amsterdam were doing better, up 45% and 49% respectively. Leading the pack are luxury hubs, Vogue says, such as Vienna, Zurich and Geneva, which are up in the 65% to 70% range.

The best-performing European cities include Rome, Milan and Stockholm, which Google shows are seeing about 80% of their pre-pandemic-level traffic.

Those trends, along with data from Signifyd’s Commerce Network indicate that consumers are shopping in stores and online — and in the case of click-and-collect, doing both at the same time.

As interesting as the strong overall ecommerce trend is, even more interesting than how much Europeans are buying online is what Europeans are buying online. For instance, based on May’s purchasing patterns, consumers appear ready to get moving and to be seen by others beyond those they live with.

Auto, Parts & Tires vertical driving big ecommerce upswing

The largest increase, and one that might deserve further study, was in the retail vertical that includes autos and their parts, including tires. Sales in the vertical were up 796% over last May, which granted, was a time when no one was going anywhere and few were in need of a new automobile or parts for an old one.

Some of the other highest performing verticals appear to be a continuation of patterns consumers established while stuck at home. Home Goods & Decor sales were up 375% year over year. Leisure & Outdoor, which enjoyed a strong run as consumers were establishing home gyms and buying games and such to keep themselves entertained, saw spending rise 329% in May, compared to May a year ago.

The other high-performing categories were somewhat predictable if you give it even the slightest bit of thought. Luxury Goods saw a 231% rise and online Beauty & Cosmetic sales were up 180%. Consumers appear to be thinking about getting out to see and be seen, given the strength of sales of nice jewelry, high fashion and cosmetics.

Perhaps the only reminder that the world is still facing a global health crisis was the steep rise in Consumer & Medical Supplies. Sales in the vertical were up 308%, though it is hard to know whether COVID-19 played a major role in those purchases.

And finally, in a possible sign that as economies open up, online shopping habits might change, consider what happened as pubs in the UK and restaurants and bars in other parts of Europe began to reopen. In May 2021, sales in the Alcohol, Tobacco & Cannabis vertical dropped 24% compared to May 2020.

You remember May 2020, right? It was a time for much of Europe that if you really wanted a drink or a pint, you had better pour it yourself.

Photo by Getty Images