The sigh of relief you heard across the land in April was the sound of a new bunch of online grocery shoppers taking advantage of modulating pricing in the digital supermarket aisles.

Online grocery sales were up 22% year over year last month, according to Signifyd Ecommerce Pulse data. The boost in sales was driven by a slowdown in the rise of grocery prices, which apparently attracted new consumers to the online shopping option.

Let’s look at the numbers. Yes, grocery prices are still on the rise — Signifyd data shows that supermarket inflation year-over-year sat at .5% in April. But a year ago, the inflationary squeeze was dramatically worse. The annual price gain in April 2023 hit 7.5% compared to a year earlier. This April’s relief drew in 18% new online grocery shoppers, according to a Signifyd analysis of digital profiles attached to grocery orders.

April year-over-year online grocery sales: A deep dive

| Sales | +22% |

| Number of digital shoppers | +18% |

| Number of transactions | +34% |

| Average order value | -9% |

| Product volume | +29% |

| Cart size (No. of items per order) | -4% |

So, what’s the catch, you ask? Well, despite the growing enthusiasm for online shopping, the average amount each shopper spent per order in April was down 9% from a year ago.

“There are more online grocery transactions occurring than last year and this is driven by an influx of new customers,” says Signifyd Data Analyst Phelim Killough, who prepares the company’s monthly Pulse report. “On average consumers are buying less as these new customers test the channel as well as exhibiting lingering price sensitivity with still elevated, albeit plateaued, prices.”

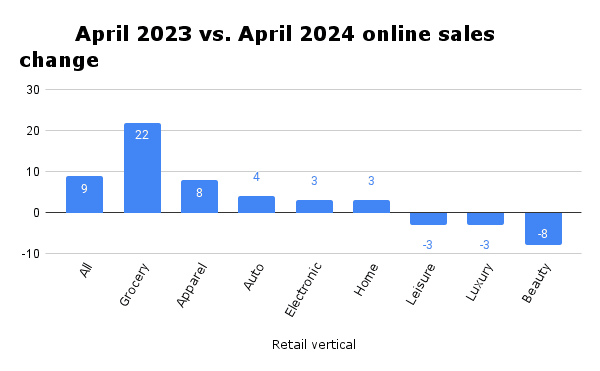

The small cart sizes were not enough to knock grocery out of the top spot for annual sales increase. The category’s 22% boost dramatically beat out the year-over-year increase in sales for all verticals, which landed at 9% in April, according to Signifyd’s Pulse Data.

Overall, five of the eight key retail verticals were in positive territory in April compared to a year ago. Besides grocery — apparel, auto parts, electronics and home goods all saw sales that eclipsed April 2023.

April 2024 ecommerce sales compared to April 2023

| Apparel | +8% |

| Auto parts & tires | +4% |

| Beauty & cosmetics | -8% |

| Electronics | +3% |

| Grocery | +22% |

| Home goods & decor | +3% |

| Leisure & outdoor | -3% |

| Luxury goods | -3% |

| Ecommerce – all verticals | +9% |

The slowing rise in the price of groceries noted by Signifyd was in keeping with trends outlined in recent inflation reports from the U.S. Bureau of Labor Statistics, which saw prices for food purchased for consumption at home rise 1.2% between March 2023 and March 2024.

April also saw the continuation of a troubling trend: Fraud pressure across all verticals was up 24% compared to a year ago. Fraud pressure is a measure of the rise and fall of orders determined by Signifyd’s AI models to be very risky and therefore likely fraudulent.

The increase in payment fraud was accompanied by a rise in consumer abuse — false claims that a package never arrived, for instance, or that an order that did arrive was significantly not as described on a merchant’s site or was otherwise defective.

Such claims have been on an upward trajectory since the pandemic and have at times been rising faster than traditional payment fraud.

For more April data, including fraud trends; buy online, pickup in store; buy now, pay later; sustainable goods trends and private label sales; visit Signifyd’s Ecommerce Pulse Hub.

Signifyd Ecommerce Pulse methodology

Signifyd’s Ecommerce Pulse data is derived from transactions on Signifyd’s Commerce Network of thousands of ecommerce retailers and brands. Commerce Network intelligence also powers Signifyd’s Commerce Protection Platform, which leverages AI-driven machine learning models and data from millions of transactions to detect and block fraudulent activity. Signifyd has seen more than 600 million unique shopper wallets globally, meaning that 98% of the time when a shopper comes to a Signifyd-protected site, Signifyd’s machine-learning models recognize the shopper instantly.

Photo by Getty Images

Interested in digging into the ecommerce data? Let’s talk.