We can call it: The holiday shopping season is on. Full force. The anecdotal evidence has been piling up for the past few weeks:

Consumers spooked by supply chain kinks heading to the mall before Halloween for holiday gifts. Nearly half of retailers telling pollsters their peak season started in September. Retailers launching holiday promotions and price matching six weeks before Black Friday. Merchants taking extraordinary steps to accelerate cargo shipments while warning consumers they could be out of the good stuff by Black Friday.

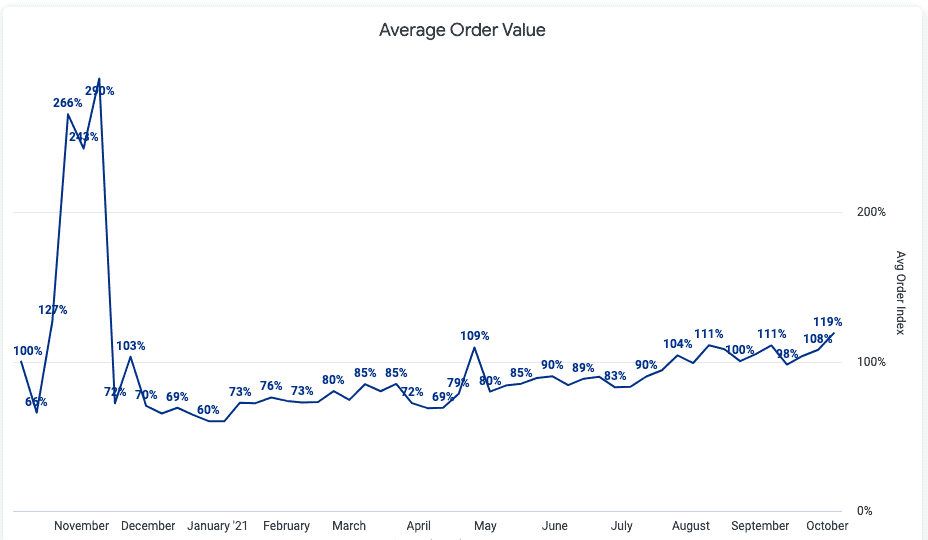

And now the data confirms it: Ecommerce in the first week of October was up 23% over the same week a year ago, according to Signifyd’s Ecommerce Pulse data. Moreover, shoppers are spending more, with basket sizes up 19%, a likely sign that holiday shopping is going full steam.

The trend tracks with retailers’ accounts, and in fact big spending increases can be traced back to September, which saw ecommerce revenue for the month on Signifidy’s Commerce Network up 44% year-over-year.

Full baskets are a sign of full-on holiday shopping

And basket size — or average order value — is not only impressive, it is at its highest point so far this year. The data also shows that a bigger proportion of online spending is coming from shoppers who have been transacting on Signifyd’s Commerce Network for a year or more — indicating an increasing comfort with online shopping, meaning these patterns are no pandemic blip.

The data shows another pattern, one less positive for retailers than the rest — fraudulent activity and claims for refunds from shoppers who say — legitimately and falsely — that retailers have done them wrong are at historic highs.

Taken together, the numbers sketch a picture of commerce activity far more typical of the heart of the holiday shopping season than the October calm between the storms of back-to-school shopping and the winter buying season.

“I mean any year that big retailers like Home Depot, Costco, Target and Walmart are chartering their own navies to ensure they have cargo ships to get their goods to the U.S., you know something unprecedented is going on,” Signifyd Director of Product Marketing Ashley Kiolbasa said.

The cause for the early commotion is a list of what have become the usual suspects, starting with the COVID-19 pandemic. The global crisis pushed more shoppers online for good. It also wreaked havoc with supply chains as factories making goods have closed for health reasons. It left fortunate consumers with an excess of disposable income and a renewed penchant for buying goods over experiences, which drained inventory.

And it ignited a form of wholesale hoarding with big retailers accelerating their orders from suppliers and factories to get ahead of bottlenecks, leaving a shortage of trucking capacity and cargo ships and containers.

COVID and its ripple effects mean a holiday shopping season like no other

The massive global disruption resulted in news story after news story pointing out that this will be a holiday season like no other — unprecedented demand meets severely depleted supply.

“I think Johnny is going to get a back-order slip in his stocking this year,” is the way North Carolina State University supply chain management professor Robert B. Handfield put it to The New York Times.

Not if Johnny’s loved ones can help it. Never underestimate the determination of a consumer working to make holiday dreams come true. If recent years have aroused consumer complaints of holiday creep — the steady, earlier-and-earlier shift of holiday commercialism — 2021 is the year that shoppers have said, “Bring it. The earlier, the better.”

Consumer online spending by order value is higher now than at any point since November — the height of the holiday shopping season. That is good news for retailers and an indication that they have so far been able to meet consumers’ needs. It’s also a sign that they can expect order volume to increase and continue at a high level through at least the end of the year.

What sort of order gusher can retailers expect? Consider that order volume during last year’s Black Friday period was twice the October 2020 peak.

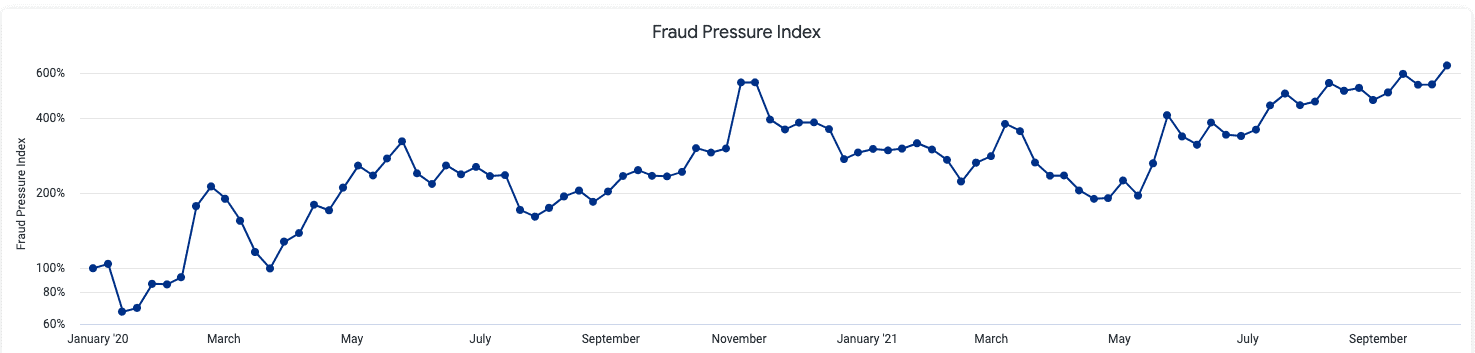

There are warning signs, too. As holiday shopping has heated up, so have fraud rings’ attempts to cash in during the holiday run-up. Fraud pressure on Signifyd’s Commerce Network is at historic highs, exceeding its 2020 peak. The index is currently running nearly 550% higher than it was in January 2020, according to Signifyd’s Fraud Pressure Index. The fraud pressure index charts the rise and fall of very high risk — and presumably fraudulent — orders over time on Signifyd’s network of thousands of merchants. Fraud levels are compared to a January 2020 benchmark.

Trends — good and bad — make the case that holiday shopping is here and now

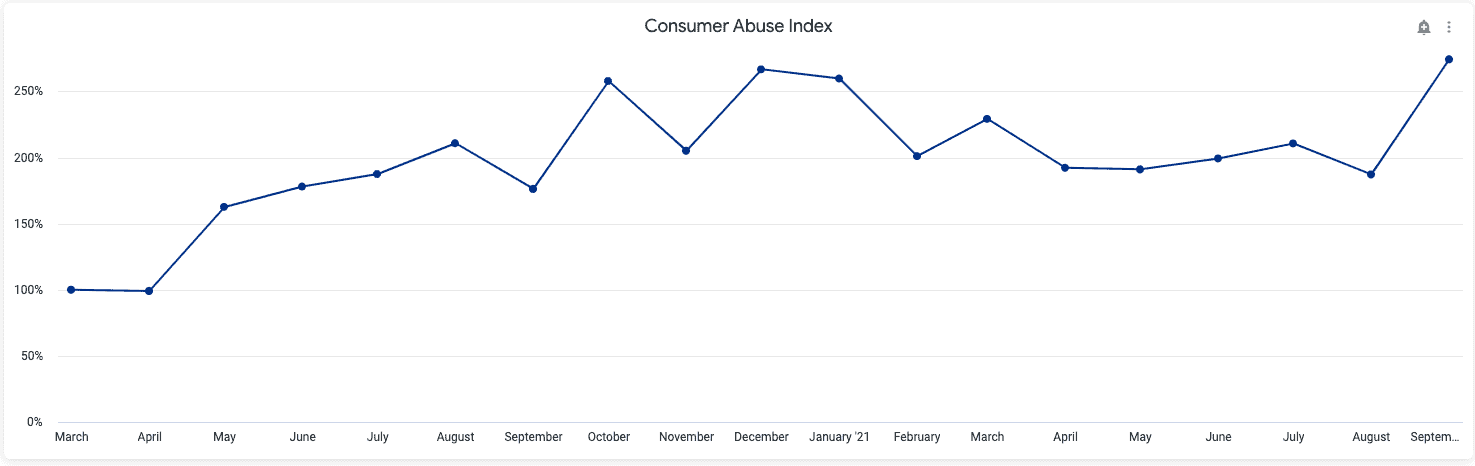

Consumer abuse — complaints that an ordered package never arrived or that an ordered product was unsatisfactory — is also on an upswing. Signifyd’s Consumer Abuse Index is at its highest point since the start of pandemic lockdowns in March 2020. Like payment fraud, the abuse index, which measures merchant protection from chargeback claims on Signifyd’s network, has surpassed 2020’s peak — running 174% higher than at the start of the pandemic.

A chargeback is a claim a consumer makes against an online retailer arguing that a credit card charge should be reversed. The claim can be filed for any number of reasons, including that a package didn’t arrive or that a product was unsatisfactory.

While Signifyd has seen an increase in fraud and consumer abuse attempts throughout the pandemic, the uptick during what is now the holiday shopping season should put retailers on notice that these threats are likely to persist and perhaps increase as the holiday season moves towards its traditional Black Friday start.

Black Friday start. Sounds quaint, doesn’t it?

Signifyd Data Analyst Phelim Killough contributed to this report.

Interested in automating your order flow for holiday order surges? Let’s talk.