In a year like no other, it stands to reason that we’d have a November for ecommerce like no other, with strong year-over-year sales growth powered by more than the usual suspects.

November 2020 established that Cyber isn’t just for Monday anymore and that Black isn’t just for Friday anymore, according to Signifyd Ecommerce Pulse data. While the triumvirate of shopping holidays — Thanksgiving, Black Friday and Cyber Monday — contributed to the roughly 50% same-store growth for all of November, the days leading up to the holiday-shopping kickoff pulled significant weight.

- Online same-store sales for November were up between 49% and 56% year-over-year, depending on the region of the world.

- Thanksgiving, Black Friday and Cyber Monday were important contributors, but November’s no-name days actually did the heavy lifting, Signifyd data shows.

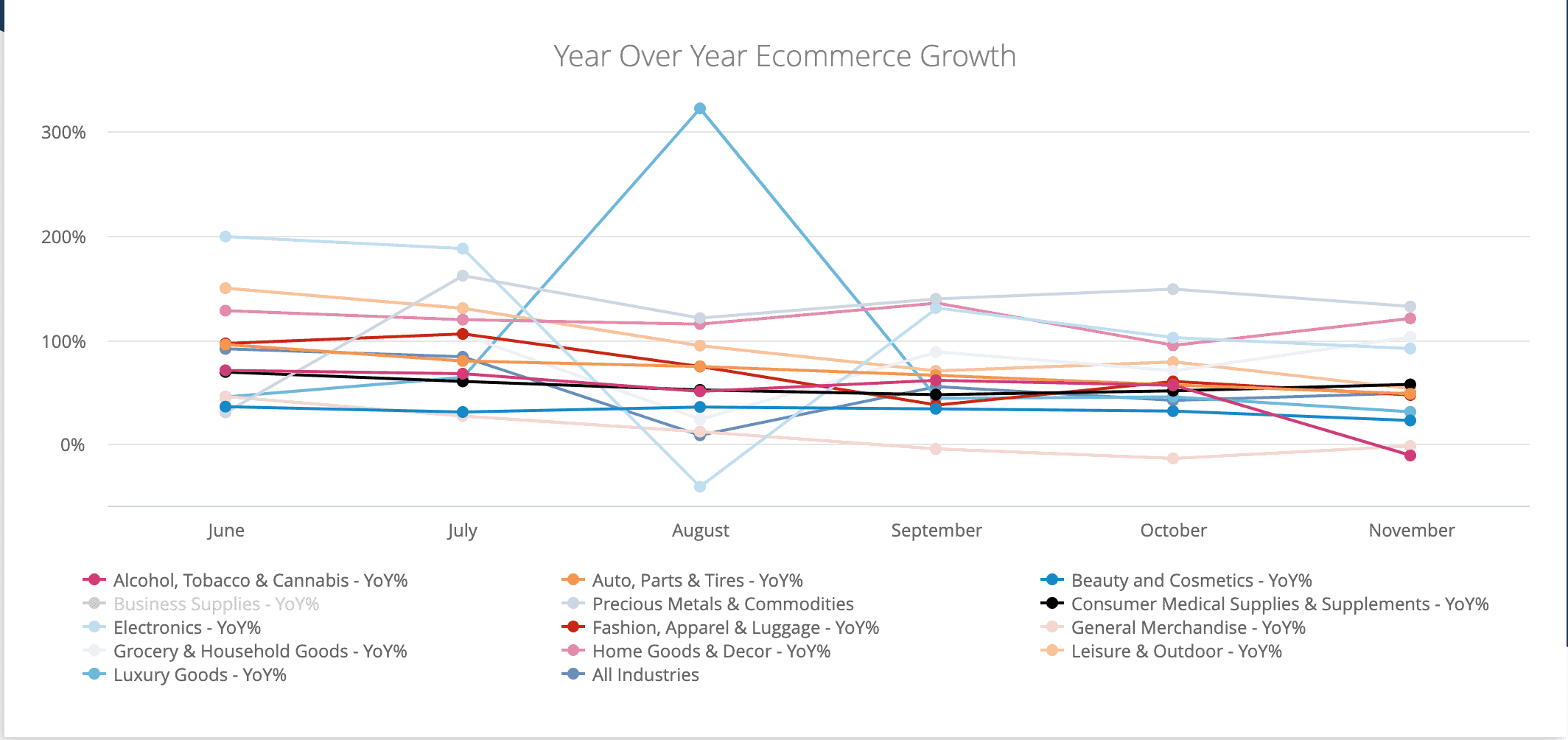

- Sales data for individual retail verticals indicates that consumers are relying heavily on ecommerce for everyday needs, while also revving up holiday shopping.

Sales for the five days from Thanksgiving through Cyber Monday were up 30% from the Cyber Five period in 2019. But for the entire month, online sales year-over-year were up 56% in Europe, 52% in the United States and 49% globally, Signifyd data shows.

“Retailers and retail analysts have been talking about spreading promotions and shopping events among more days this holiday season in light of COVID-19,” said Pranav Gandhi, Signifyd head of business & strategy analytics. “We are definitely seeing that in our numbers. Thanksgiving, Black Friday and Cyber Monday certainly performed very well, but November overall performed even better in terms of annual lift.”

Retailers have been working consciously to spread order spikes out and to prompt shoppers to buy early by offering promotions earlier. COVID-19 has driven more shoppers to do more shopping online, which caused concerns that supply chains and fulfillment operations might be swamped if shopping were concentrated over the traditional six-weeks or so of holiday shopping.

Retailers pushed early promotions to avoid fulfillment snags and costs

By encouraging earlier and more consistent shopping, retailers hoped to ease pressure on fulfillment. They also wanted to avoid shipping surcharges levied against high-volume shippers — and even avoid the possibility of being cut off by shippers altogether.

“This certainly isn’t the first time we’ve seen retailers push sales early,” Tyson Cornell, of PwC, told Retail Dive in an October email. “The difference now is that more of the industry is getting on board, and if it goes well, these early sales could have a lasting impact on the traditional holiday sales cycle.”

The results so far must be encouraging for retailers in the midst of a holiday shopping season disrupted by pandemic-induced social restrictions and financial strains. In fact, certain retail verticals rose to sky-high levels that were familiar early in the pandemic.

In the U.S. loved ones might be finding bling, smartphones, tablets and laptops under the tree, given the performance of the Electronics and Precious Metals & Commodities verticals in November. Precious metals sales were up 131% year-over-year. Electronics was not far behind, up 110%, according to Signifyd Ecommerce Pulse data.

Home decor looks to be a hot gift this season

Other gifts potentially coming your way in the U.S. might include a little something for the house. Home Goods & Decor sales soared 92% year-over-year. The Leisure & Outdoor goods category saw 51% growth in November. Fashion, Apparel & Luggage items apparently were on a lot of shopping lists. Sales grew 41% in the month just ended. Luxury Goods and Beauty & Cosmetics also put in strong showings, with online sales increasing by 27% and 25% respectively.

In a sign that life goes on in the holiday season, even in the midst of a pandemic, online sales of Grocery & Household Goods in the U.S. were up 97%. It seems shopping for food from home had become an entrenched habit. Meantime, Auto, Parts & Tires notched a 46% increase in the U.S. and Consumer Medical Supplies grew by 45%

Europe had its share of November winners, too. Many of the big increases were in verticals associated with practical purchases. That might reflect the waves of lockdowns and restrictions during the month that were more severe than those in the U.S.

For instance, Home Goods & Decor sales increased 265% in Europe, while Auto, Parts & Tires soared 342%. Grocery & Household Goods rose 104% and sales of Consumer Medical Supplies & Supplements were 102% higher than a year ago.

Mobile phones will be under the tree in Europe

But there were upticks that could be attributed to Christmas shopping, as well. Online Electronics sales in Europe saw 109% year-over-year growth. Leisure & Outdoor sales increased by 85%. Fashion, Apparel & Luggage rose 78%, while Luxury Goods and Beauty & Cosmetics were up 51% and 57% respectively.

In all, November’s online sales provided a particularly strong showing across a broad range of verticals — and across a broad range of days in the month. All of which must have retailers breathing a sigh of relief while they steel themselves for the final three weeks of the holiday shopping rush.

Photo by Getty Images

Data provided by Signifyd’s Business Intelligence Team

We can help with holiday order spikes.