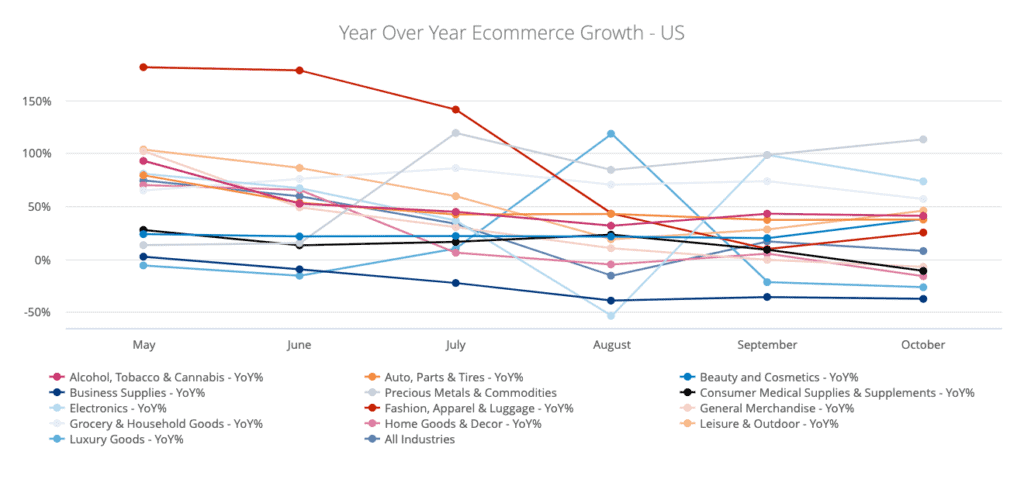

Online holiday shopping is apparently not off to the fast start many predicted, Signifyd’s Ecommerce Pulse data for October shows.

That’s not to say ecommerce is not still thriving during the pandemic — a time when shutdowns come and go and many consumers are nervous about spending significant time in brick-and-mortar stores.

Globally, ecommerce sales were up 7% over October 2019 and a number of retail verticals saw much higher sales. U.S. spending reflects a similar pattern, with overall ecommerce sales improving 8% over last October. And in Europe ecommerce sales rose 4% compared to a year ago, with some verticals reaching triple-digit increases year-over-year.

The modest sales boosts might worry retailers and prognosticators who have been saying that this year’s holiday shopping would start far earlier given consumers’ concerns about product availability and retailers’ concerns about overwhelmed delivery and supply chains creaking under the predicted avalanche of online holiday orders.

Ecommerce spending was up slightly year-over-year in October — globally, in the U.S. and in Europe. Here are some of the month’s big winners globally by retail vertical.

- Electronics sales were up 69%

- Alcohol, Tobacco & Cannabis rose 37%

- Cosmetics & Beauty increased 32%

Retailers have an additional incentive to nudge holiday shopping earlier, given that most of the major delivery companies — UPS, FedEx, the postal service, etc. — have instituted shipping surcharges for ecommerce enterprises that ship high volumes in November and December.

How did Prime Day affect non-Amazon spending?

And then there was Amazon Prime Day, which actually runs for two days. Analysts pointed to the shopping holiday — moved from July to October in 2020 — as the new kickoff of this year’s holiday shopping season. Think Black Friday in October.

While Signifyd’s Pulse data does not account for Amazon sales, online retailers not named Amazon often see a boost during Prime Day, as consumers are more prone to comparison shop and many retailers offer their own deals to take advantage of the consumerism in the air.

But it’s possible Prime Day’s typical halo effect was diminished in 2020, given that the pandemic has at times upended conventional wisdom. The sales event saw plenty of spending — $10 billion by credible accounts — and it’s possible consumers decided to leave it at that this year, rather than hunt for more bargains on other sites.

Surely, the pandemic itself, and the rise in COVID cases in many parts of the world, could have dampened enthusiasm for spending. Europe’s respectable, but hardly outsized, 4% year-over-year spending increase coincided with lockdowns, looming lockdowns and conservative consumerism in the region.

The Confederation of British Industry’s retail index fell to its lowest level in four months in October, The Guardian reported.

“A reluctance to maintain the summer spending spree through the autumn months reflected increased restrictions on household activity in many parts of the country, rising unemployment, cutbacks in government support for furloughed workers and mounting consumer caution,” the publication said.

In Signifyd’s own polling, 54% of UK consumers said their incomes had been adversely affected by the coronavirus. The survey, conducted by market researchers Upwave, found that 67% of respondents planned to spend less this holiday season than a year ago, with 43% saying they would spend considerably less.

The story was similar in the U.S., where 56% of consumers said their incomes had been adversely affected by the coronavirus, and where 59% said they would spend less on holiday gifts in 2020.

In the U.S. election, stress and lack of stimulus may have slowed spending

U.S. consumers had other reasons to hold off on holiday spending in October. The U.S. Congress has been debating whether to enact another round of aid for consumers — meant to help them cope and to prop up the economy. October also marked the run-up to a national election, including for the office of the president.

It’s possible that consumers are waiting to see if relief checks are coming before doing their serious holiday shopping. And big events, such as an election, have been known to cause the sort of uncertainty that dampens spending while consumers wait for the dust to clear.

All that said, some verticals saw dramatic year-over-year growth in October. Globally, Electronics sales were up 69%; Leisure & Outdoor was up 66%; Alcohol, Tobacco & Cannabis rose 37%; Beauty & Cosmetics saw a 32% rise and Fashion, Apparel & Luggage increased 21%.

It’s highly unlikely that all of that spending was holiday related, though those categories certainly include popular gift items. On the other hand, not so gift-friendly vertical Auto, Parts & Tires saw sales climb 40% over a year ago.

Big winners in the U.S. included Electronics, which saw a 73% sales increase, Grocery & Household Goods, which were up 57%; Leisure & Outdoor, which saw a 46% rise; Beauty & Cosmetics, up 38% and Fashion, Apparel & Luggage, which logged a 25% increase in sales.

In Europe, Auto, Parts & Tires led the way, up 174%. Consumer Medical Supplies sales rose 125% and Home Goods & Decor saw a 102% rise.

The Ecommerce Pulse Data is drawn from Signifyd’s Commerce Network of thousands of merchants selling in more than 100 countries around the world.

Feature photo by Getty Images, chart by Signifyd

Talk to us about scaling up for the holiday order surge.