In the midst of economic uncertainty, British retailers can at least celebrate a fast start to 2019 — though it’s unclear just how long the party will last.

It’s alway something, right? The good news: Shoppers are back both at stores and their computers, spurring exceptional early-year growth in retail sales after the High Street’s worst holiday shopping period in a decade.

We had a chance to talk to David Buckingham, CEO of Ecrebo, at this year’s NRF Big Show about the reasons behind the disappointing holiday period. And while many of the reasons he cites would appear to still be in play, it’s possible the January sales bump was brought on by pent up demand or, more likely, aggressive discounting.

Buckingham, whose company provides tools to collect, manage and use comprehensive point-of-sale data, ran down some of the pressures that led to the poor holiday season in the UK in the video interview below.

UK sees best January boost in years

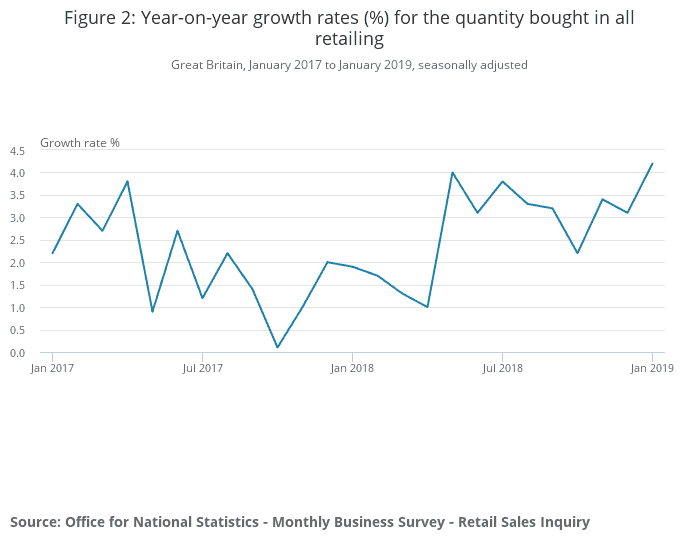

Despite the dreary macro-trends that Buckingham chronicled in our interview, the Office for National Statistics has reported that January retail sales in the UK were up 4.2 percent year-over-year. The increase was the most robust since December 2016, the office said. The figure was also something of a relief after December’s report, which saw a .7 percent month-over-month decrease in shopping activity during the height of the holiday shopping season.

The Office for National Statistics report cited strong sales in the apparel sector, possibly due to lower prices, which were down year-over-year by nearly 1 percent. Online sales continued to perform strongly, up 9.8 percent year-over-year in January, when they made up 18.8 percent of retail sales. Even during December’s sluggish stretch, online sales were up 13.9 percent over December 2017.

There is little doubt that ecommerce as a percentage of retail sales will continue its upward trajectory. Whether retail in the UK will continue its recovery — or how long any recovery will last — is less certain. History has proven that retail sales fueled by discounts are not sustainable. If consumers are drawn in by price alone, they will continue to demand lower prices, straining margins beyond the breaking point.

It becomes a little like the joke about the company that was selling trousers and losing £3 on each pair. “Don’t worry,” the company manager told investors. “We’ll make up for it in volume.”

Brexit: the spending drag that won’t go away

The anxiety and uncertainty over Brexit — and when it will happen and how it will happen — will no doubt continue to weigh on consumers, who have periodically pulled back spending. Retail sales, by their nature, tend to fluctuate. But retail spending in the UK of late has produced a particularly feverish fever chart.

Rachel Lund, head of insights and analytics for the British Retail Consortium, offered a reminder of the volatility of the market when she talked to The Guardian about the positive start to the year.

“The discounts which drew shoppers into stores won’t last forever,” she told the news outlet. “With uncertainty surrounding Brexit weighing on consumer confidence, once the period of seasonal promotions is over, households are likely to remain cautious with their spending.”

We, of course, will see. And we might not be waiting long to find out.

Photo by iStock